Articles

13 Rules of ICO Investing

Published

6 years agoon

By

TokenFlipper

One of the biggest use cases of cryptos besides Bitcoin has undoubtedly been ICOs (initial coin offerings) which allows anyone from anywhere in the world to easily raise money for a blockchain based venture and provide liquid tradeable tokens to investors that often represents a currency on the platform. This trend really exploded in the summer of 2017 and reached a peak in early 2018 with money raised totaling $6.3 billion in Q1 alone. Despite it falling off in recent months, it’s not something that’s going to just disappear due to the easy way in which it allows for venture capital and startups to effortlessly meet in a digital world. While investing in the right ICOs have resulted at times in incredible gains at times surpassing 100x returns within a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. They won’t guarantee that you’ll stumble upon a winner, but it will most certainly reduce your chances to falling prey to many of the mistakes people make when putting their money in ICOs.

ICO investing has exploded in the last year…which has brought with it many risks.

Rule #1: Understand The Risks

This might sound a bit obvious as there’s a level of risk involved in pretty much any investing, but you won’t know true risk until you get yourself involved in the world of cryptocurrencies and especially ICOs. The things that happen in this space is mind-boggling and often times ridiculous, you’ll at times wonder how any of it is possible in this day and age when you’d think there should be rules and regulations to prevent some of this seedy behaviour from taking place. This is in fact why we started this website in the first place, to shine a light and do our best to help folks navigate the wild west of tokenized assets.

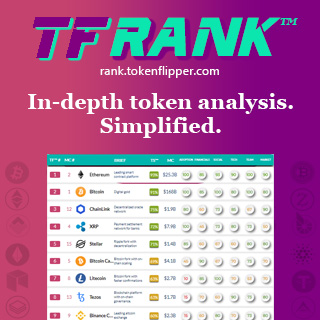

The above image looks like a transparent and investable team, except it’s not even real.

What do we mean by risks besides a very real chance that your investment could lose 90% of its value under a year? The team could have fake profiles like Benebit (pictured above), they could drastically switch the terms of their ICO like Mercury Protocol after launch, they can increase their hard cap after reaching a level of popularity like Enigma, they could cancel their ICO after a lengthy vetting process like Gems Protocol, or well…they could just exit scam with the money like dozens of projects do every month. You might be wondering why even participate in any ICO if the space is riddled with such shady behaviour, and the simple answer is that it is such risk that allows the few winners to post life-changing returns as is the case of successful ICOs like Ethereum, Neo, and Stratis just to name a few.

Rule #2: Realize You’re Investing In The Team

While ICOs are selling you on a revolutionary future and making all sorts of promises about their product, what you’re really investing in when you put money in ICOs is the team. Given that the ICO investment space is still largely unregulated and investments at max come with a loosely binding SAFT (Simple Agreement for Future Tokens), you really have to trust that the team is going to do right by the investors. Obviously an anonymous team is an absolute no-no and clear links to each team members LinkedIn or equivalent pages are a necessity so you can do your due diligence.

Different people have different methods for evaluating the team but past performance is indeed the best indicator of future performance in this case. You may think that the 19 year old CEO with no work history could be the next Vitalik Buterin, chances are he’s not and you’ll already be needlessly exposed to a gamble when there are already so many other facets of the investment that involve much risk which you can’t actually control. Another risk is picking teams from specific regions like Eastern Europe or China where the regulatory, business, and ethical frameworks are not as transparent or developed, and thus there’s increased chance of getting burned.

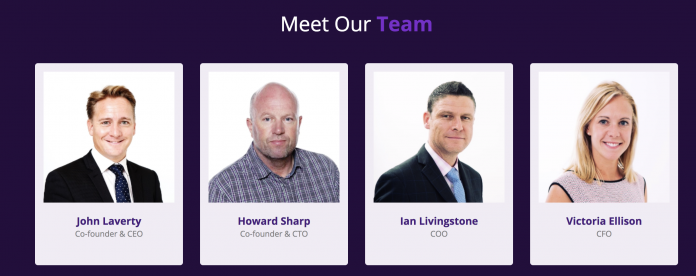

Dan Larimer’s success in previous crypto projects was one of the predominant reasons why investors were happy to give him billions when he launched the EOS ICO.

A mix of experience working on blockchain related projects and a link to the real business world where the project is going to be operating is the ideal mix. Often times you have an over concentration of one or the other and that will lead to either not enough development or not enough business development, both of which will lead to a project’s downfall. A leader that has proven entrepreneurial skills and built and exited a successful startup goes a long way.

Rule #3: Analyze The Advisor & Promoter Choices

While the intentions and mindset of the team might be hard to decipher based on looking at their resume, the way in which they go about picking advisors and influencers will be a very clear signal as to what kind of project you’re dealing with. ICOs that are looking for a quick raise and exit are much more likely to hire advisors that have short term benefits like ICO influencers and well-respected business folk that at first seem to lend the project legitimacy but you soon realize have their name tagged to dozens of ICOs and are basically just cashing in without providing much added value. We won’t call anyone out but stick around for a while and you’ll know exactly who these people are.

Paris Hilton promoting a shady project founded by a man convicted of domestic violence was the peak of the ICO bubble.

Another huge red flag that almost single-handedly should see you running for the exit is when ICOs use celebrities to promote their coins. While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question. Steven Segal even went on to promote a blatant scam ICO called, we shit you not, Bitcoiin with two i’s that unsurprisingly ended up being a pyramid scheme.

Rule #4: Make Sure The Price Is Right

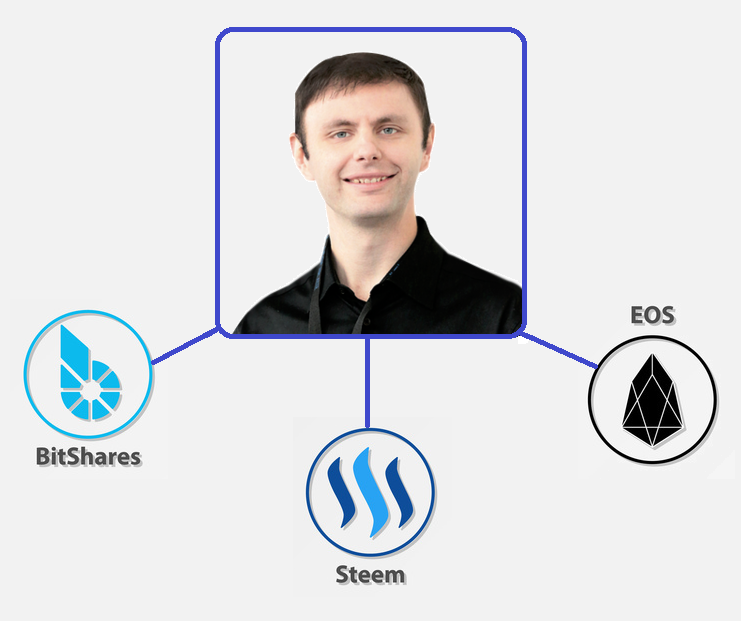

Even the sounding ventures can be worth a punt when priced low enough and even the best sounding projects won’t make for a good investment if priced too high. The market cap of the project is the figure that’s looked at when evaluating this metric and it’s calculated by multiplying the ICO price of the token by the total amount of circulating tokens (funnily enough the total token supply is largely ignored in the space).

Currently Stellar Lumens has a higher implied market cap (when factoring in total supply) than even Ethereum, but market only seems to care about circulating supply.

What constitutes the right market cap from an investment standpoint has actually very little to do with how much the team really needs to execute their vision but more to do with the state of the market (whether we’re in a bull or bear market trend) and the type of project that the ICO is building. Infrastructure projects which are building new blockchains or new protocols tend to command a higher valuation in the market compared to projects that are building dApps (decentralized apps) on an existing platform like Ethereum.

For example in a down market, even $10 million might be too much for a dApp regardless of how amazing it sounds (eg: a decentralized Airbnb) while in a bull market investors won’t bat an eye throwing $50 million+ at a new “next-generation 3.0/4.0” blockchain project. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. These type of investments have historically not had the greatest ROI so keeping it at under $50m for a great infrastructure project and less than $15m for a dApp is a good bare maximum when considering the amount raised.

Rule #5: Project Vision/Idea Aligning With The Team & Trends

Normally the idea behind a project is the first and nearly only thing that a newbie investor will consider, but in our view it holds much lesser importance. The first question that should be asked is whether the project really needs to be on the blockchain or be decentralized, the wrong answer here and the investment case no longer exists. But beyond that we already highlighted in rule #4 that the scope of the project is more important in investor’s eyes during the speculative stage than the specific business idea itself. In terms of the specific idea, it’s more important in the short term that the market, regulatory, and business trend is aligned with the idea. For example a decentralized exchange project might be deemed attractive if we’re in a period where centralized exchanges are struggling or getting shutdown and not many alternatives exist, but much less so if there are already countless decentralized ICO projects and centralized exchanges are thriving (as is the case today). Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options.

Theta is building a next generation video delivery solution but probably no one would care if they didn’t have the matching personnel.

From a more long term perspective, the execution of the idea has a much better chance at being successful if the team and advisors around the project are seasoned veterans in the specific field where they’re trying to apply a blockchain based solution. For example the crypto credit card project STK did not fare very well in the short term as the crypto card trend died down heavily following the VISA/Wavecrest shutdowns but they have a better long term outlook because they have a team made up of former banking and credit card execs.

Rule #6: Lookout For Early Investors & Bonuses

When you hear the phrase “initial coin offering” you might be thinking you’re getting in at the ground floor, but that’s usually far from the case. Depending on when the project started its funding, there could be venture capital investors that got in way before you and have secured tokens at a much discounted rate. There’s also tactics used like a pre-sale period which is more aimed at influencers or crypto hedge funds and perhaps a few well connected whales. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you.

ICOs that give out large bonuses and use time pressure tactics are largely to be avoided.

While this doesn’t sound like much big of a deal when it’s a raging bull market and everything is mooning, the reality during a bear market is much more harsh. Everyone is much quicker to take profits and people are even happy at times getting out of the investment at breakeven. Their breakeven however, might sometimes be equivalent to you losing half of your investment as their selling push prices down way below your acquisition cost. It’s therefore imperial when participating in an ICO or even a pre-sale to know exactly who got in at how much and at what volume and what the lockups are for such discounted prices.

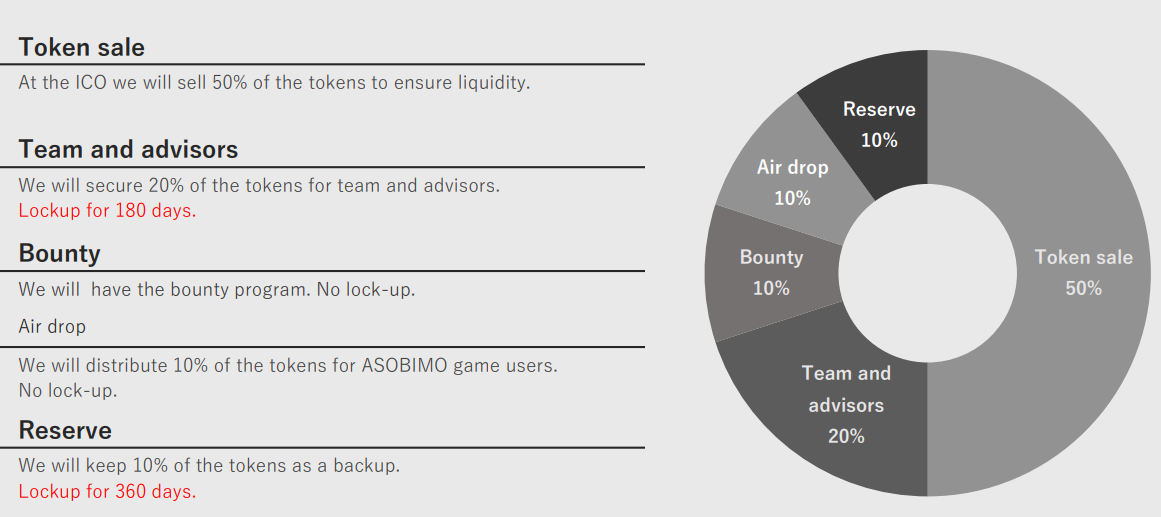

Rule #7: Make Sure Team, Advisor and Early Stage Investor Tokens Have Lock-up

Following directly from the above, it’s important for all the people who’re getting either ‘free’ or heavily discounted tokens to have a vesting period that ensures they can’t just dump them on the market. Besides protecting investors who got in at higher price, this also ensures that the team has to deliver on their milestones and actually do what they set out to do if they wish for their tokens to have any sort of value. The longer the lock-up, the more confidence you can have that the team believes in what they’re doing. Some teams have such confidence in their project that they will initiate a token buy back program like Blackmoon Crypto and that can give you somewhat of a safety net in case things go south.

Being aware of the lockup periods of the different tokens circulating the market can be really crucial in predicting the demand/supply dynamic.

For smaller projects, it’s even important to look at anyone else who might be getting free tokens like bounty programs or community airdrops. These tokens tend to be insta-dumped on the market regardless of price and not having enough volume will result in a very poor start out of the gate and could cascade into further investor panic.

Rule #8: Favorable Tokenomics & Token Distribution

We’ve covered parts of this throughout the post such as having a decent cap and guaranteeing the bonus and lockups are adequately set, but there’s a few more points here that are worth pointing out. Little things like setting the initial price low enough (such as 1c per token) can have a large psychological impact as many uninformed investors feel that tokens that costs multiple dollars are ‘expensive’ when in fact the market cap is where you’ll see whether a project is overvalued. What percentage of the total tokens are in the hands of the team compared to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective.

Another major factor is the profile of the investor base that managed to get into the ICO. Highly hyped ICOs that saw a huge number of participants like for example 0x ended up doing great as no one party got too many tokens. Recent attempts at trying to manufacture a demand deficit by limiting ICO investors through whitelists and tiny allocations however is starting to be less and less effective. Often times many people are aware what the ‘hot projects’ are and making retail investors jump through hoops like ‘proof of care’ devotions or participating in quizzes only serves to aggregate them. Fairly involving retail investors and not lazily relying on VCs or investor syndicate pools seems to be imperative going forward, especially in a downmarket.

Rule #9: When Exchange?

The phrase “when exchange?” is one of the biggest memes of the ICO world as investors constantly flock ICO telegram groups asking over and over again when the tokens they’ve bought will become liquid so they can sell and get their capital back. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. A decentralized network needs a community to thrive and allowing the free movement of tokens so new people can come in and existing early adopters are motivated to keep participating plays a big part in community building.

The joke is that there are three important questions for an ICO investor. 1) When ICO? 2) When Exchange? 3) When Moon?

It doesn’t help that the exchange listing process seems to be more of a dark art than a science as some projects seem to be quickly listed as a result of personal connections or maybe the right amount of hype behind them, while others can’t even get listed regardless of accepting to pay the exuberant amount of fees to get listings on the top exchanges. As an ICO investor, since ICOs aren’t really allowed to directly mention exchange plans you kind of have to read between the lines of where your project is going to end up by looking at connections of team members, advisors, and even whether ICO funds have been set aside for this exact purpose. Some teams will openly declare they have no interest in paying any money to get listed in exchanges, and some even have gone as far as discourage exchanges from listing them, and these are projects you should be very careful with unless you don’t mind having your capital locked up for an indefinite period of time.

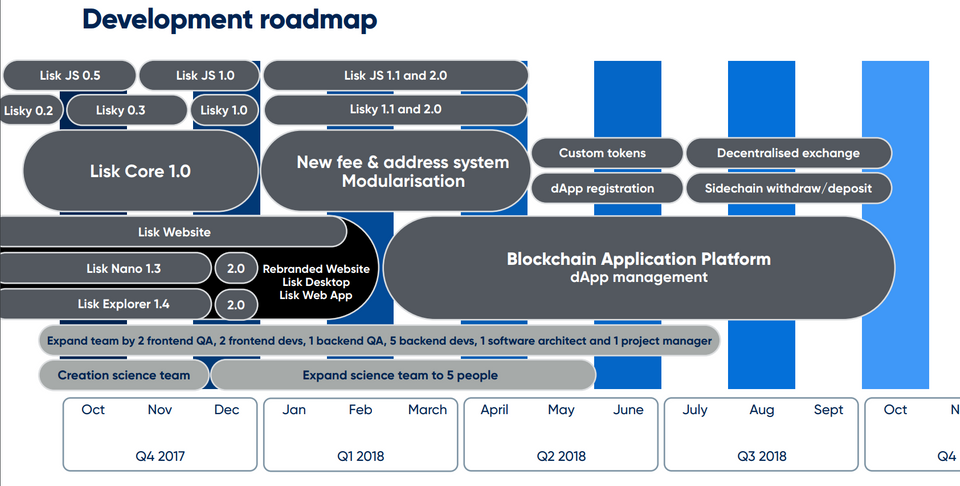

Rule #10: Having A Clear Roadmap & Timeline For A Working Product

ICO investors are largely an inpatient and restless bunch so a constant stream of news and developments is necessary to keep the spirits and confidence high and prevent early investors from dumping the token and moving on to the next shiny ICO. This is where a roadmap comes in and you’ll want to have a close eye on how detailed the roadmap is and how aggressively the dates have been set. A project that doesn’t have any milestone a few months down the line is doomed to see a lot of selling pressure. Ideally of course, a working product whether that’s an MVP, testnet, mainnet, a Beta, or a real live working product should be around the corner.

A detailed roadmap and expectation of when a working product will be ready are key requirements whether you’re investing at ICO stage or after.

There’s really no point to have your money parked backing a research project, you want something that’s going to hit the market soon or at least is going to have some kind of impact on the space and start creating value. Some even go as far as not investing in ICOs that don’t have a minimal viable product and that’s the best way to go. The communication and marketing prowess of the team to present the developments of the project in a clear, concise, and optimistic way is also key. Many teams think they should just put their headdown and work on the tech, but that often ends up being a costly mistake as the tech often requires a network effect and that can’t function without an actively engaged community.

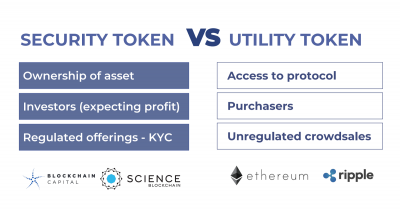

Rule #11: Needing A Real Token Use Case

Sometimes a project will get everything right but the token use case just doesn’t make sense. This is not something that many people talk about as we haven’t really reached that point of the market lifecycle where these tokens actually get used other than for speculative purposes. Many projects try to tie a utility to their token but often times the value of the business and network is not fully translated into the tokens themselves. We’re eventually going to transition into a point where many will have STOs (security token offerings) but current projects have been unable to offer investors any sort of dividend or actual share of the company’s profits because they conducted their ICO in a way to go around rules governing securities.

Realize that ICOs don’t equate to an ownership in the company. So the tokens better have real utility.

So while this rule is not so important currently, in the later stages of the lifecycle of ICOs, this is probably going to be among the most important points and it’s something you should keep in mind.

Rule #12: A Marketing Department That Understands The Double Edged Nature of Marketing

Sprinkled throughout this guide is the reminded that ICOs need a healthy community to thrive. However getting the marketing just right to achieve this whilst not appearing like a empty projects that’s mindlessly shilled is a balancing act. Projects like Tron have grown very rapidly because of their outlandish CEO Justin Sun, but at the same time they do command a questionable reputation in the space. Ripple is another company that does marketing right, but they have not presented themselves to the crypto community in the best light and continue to get many haters in the crypto community to this day.

I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. Cryptocurrency will hit 10 trillion USD market cap before @Apple and @amazon do. We will see. Time will tell. #TRON #TRX $TRX

— Justin Sun (@justinsuntron) September 12, 2018

Some projects like Chainlink have picked up bad reputations because of the practically non-existant nature of their communication and marketing. Yet they still have a cult following on sites like 4chan, so it can really go both ways and there’s no clear working formula. The announcement of announcements and other such methods are artificially tried to generate hype usually result in pump and dumps, and if done repeatedly can result in loss in the integrity of the project. At the very least, projects that have frequent and predictable updates make investors feel at ease that development is on-going and that is a nice minimum baseline to have that even projects as large as ICON realized they need. Usually you can pickup on the skill of the team in this regard during the ICO stage, so you can apply that knowledge to see how they will fare with their marketing post ICO and invest accordingly.

Rule #13: Mind The Red Flags

Last but certainly not least, you should always be looking out for red flags that might appear during the ICO funding process. Always assume something is a scam before you start looking at a project and have them convince you they’re not. This is not anything specific and can take many different forms, but if something doesn’t look or feel right, don’t get FOMO (fear or missing out) and jump into a project regardless, there’s always going to be more opportunities. Some of the possible redflags include: a whitepaper that’s been partially plagirized, a dubious money raising process like an uncapped auction, an over inflated Telegram or Twitter account followed by bots, accusations around the team’s past history, Telegram admins banning people when asked relevant questions, lacking or non-existant GitHub code repository updates, not being SEC compliant or passing the Howey test, breaking legal rules like allowing participants from countries where ICOs are banned and there are many many more.

None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points you should research in-depth and be vigilant around. Please remember that ICO investing is extremely risky and only invest what you’re willing to lose – that is probably the most important rule in all of this.

You may like

Articles

NBA Top Shot: The First Mainstream NFTs?

Published

4 years agoon

October 27, 2020By

TokenFlipper

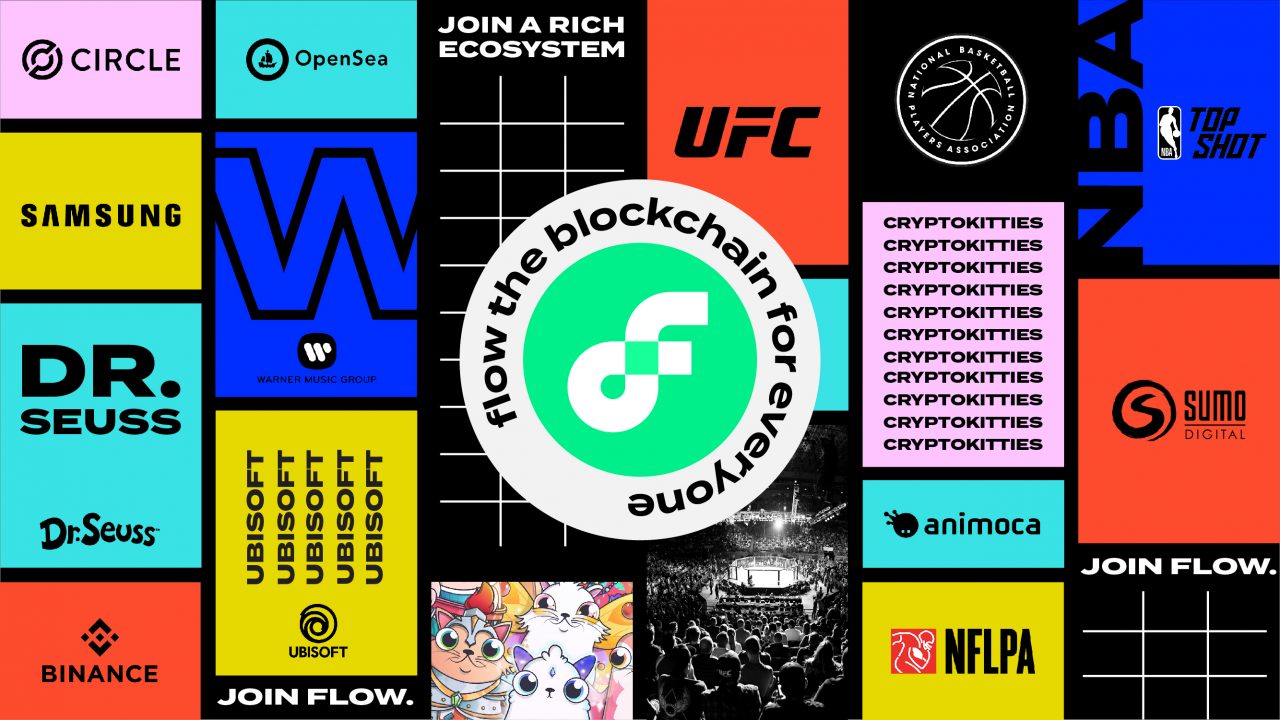

Anyone familiar with the world of NFTs will have heard of Cryptokitties and their creator Dapper Labs (formerly Axiom Zen). While the game is still going strong among its core following, outside factors like the congestion on the Ethereum network prevented the cute cat collecting game from ever going mainstream in 2017 in a way it perhaps could have. The folks at Dapper Labs haven’t sat by sulking at the state of things however, and instead elected to take matters into their own hands. They have developed a completely new blockchain dedicated to gaming, entertainment and collectibles, called Flow, launching with a flagship product: NBA Top Shot. Will NBA Top Shot be the experience that takes NFT ownership to finally go full mainstream?

Who’s Behind NBA Top Shot?

With its surprise explosion in popularity in 2017, Cryptokitties opened the eye of many collectors and gamers alike at the possibilities of the blockchain technology. On the back of this success, Cryptokitties was spun off into its own company called Dapper Labs. They’ve received north of $50 million in funding over the years and have formed strong partnerships, both due to their previous successes but also because of their future plans with Flow attracting major partners such as Samsung, Google Ventures, Andreessen Horowitz, Union Square Ventures, Coinbase Ventures just to name a few.

The Flow blockchain is not only attracting big investors, but also some of the biggest brands in the world.

The NBA Top Shot game meanwhile has scored an official NBA license and was designed in partnership with the NBA and the NBA Players Association. Investors in the project include players like Andre Iguodala, Spencer Dinwiddie, Aaron Gordon, JaVale McGee, and Garrett Temple. This, folks, is as legit as they come in the world of crypto.

What Is NBA Top Shot?

NBA Top Shot offers an interesting opportunity: “for the first time ever, NBA fans can truly own a piece of the action — and trade with friends for real money in a new kind of hoops economy.” But you might be asking yourself how does this really work . Essentially, every new real-world NBA highlight is broken down into individual moments and turned into rare video collectibles with limited supply on the blockchain.

Video showing pack opening and how an individual moment collectible looks like.

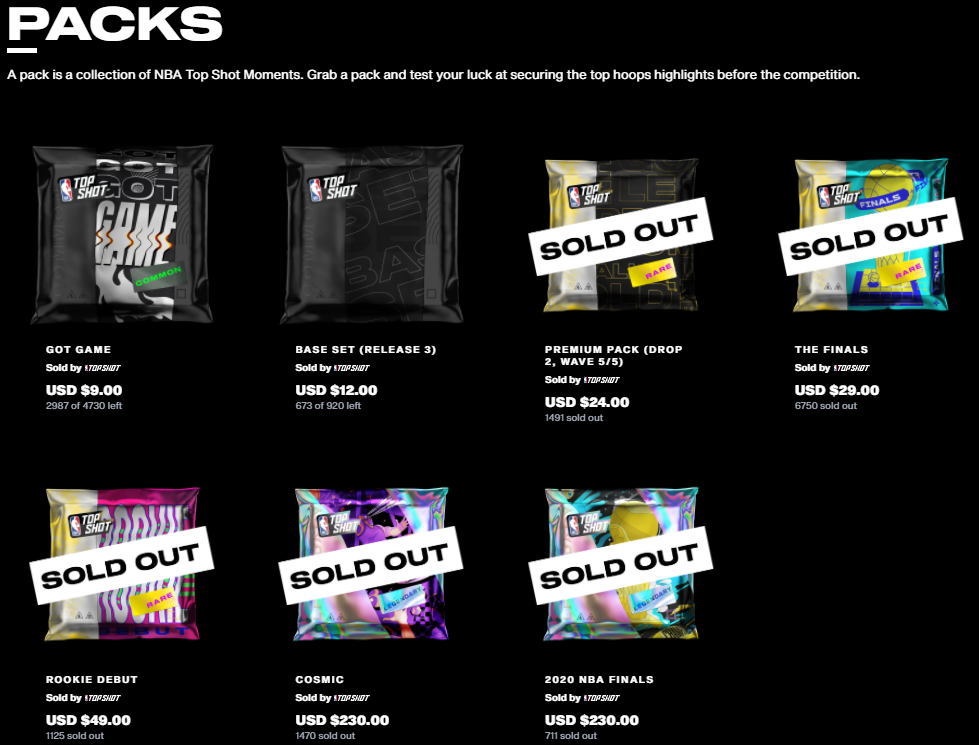

Packs that contain these highlights are sold in limited numbers, and extra layers of collectability are added in the form of rarity (changes the border of the video highlight box presenting the highlight/card itself each with different scarcities) and the random serial number which is the unique mint number within the overall edition size (for example being #1 out of a print of 50 would give it quite a big premium).

Even in digital form, there’s few things more satisfying than cracking open a pack. Securing one of the limited time and quantity packs gives an extra dose of adrenaline.

Game, Collectible, or Something Else?

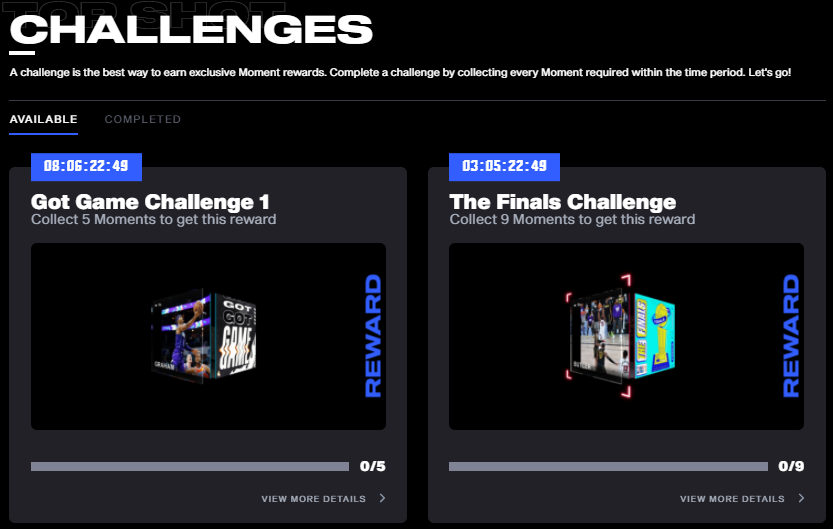

So there are these NBA highlights you can buy from packs and collect – but what else can you really do with them? Currently, the main attraction for early adopters are the limited-time Challenges that are generated by the NBA Top Shot team. These are a type of quest where you are asked to own a specific set of cards by a certain deadline and are rewarded with an exclusive moment that’s only generated through these specific challenges.

Time-limited challenges with exclusive rewards appear from time to time to incentivize completionists to either purchase lots of packs or to use the marketplace to shore up gaps in their collection.

Another section which rewards you, at least socially, for filling out your collection is the “My Showcases” section. Here you can put together your favorite moments to create a chained highlight reel or simply show off some of your most prized collectibles. For example, one user has a showcase of all #1 serial number legendaries owned – something that would certainly cater to the hardcore collector / whale demographic of this experience. For those putting a bigger premium on utility, a mobile game that will let you use your moments is currently being worked on, though details on that are still scarce.

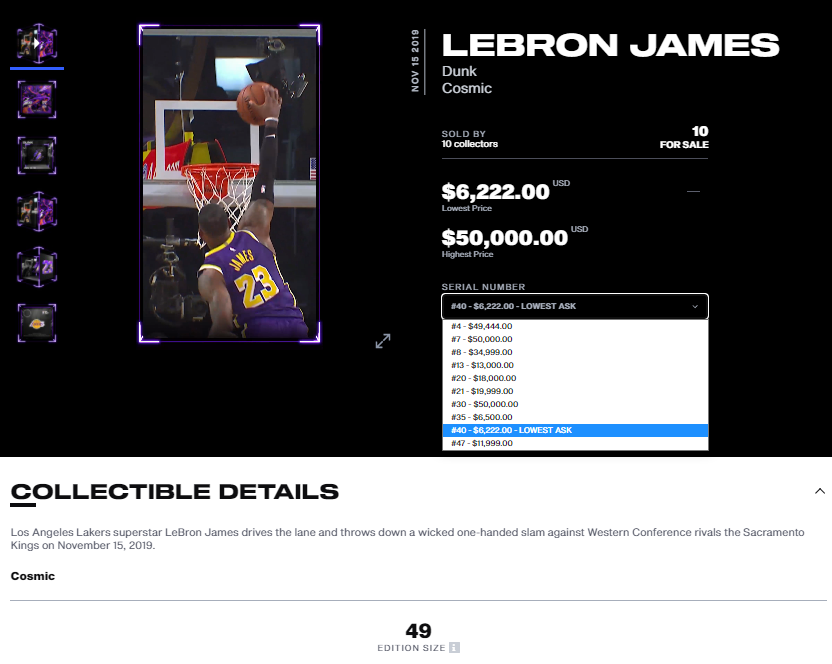

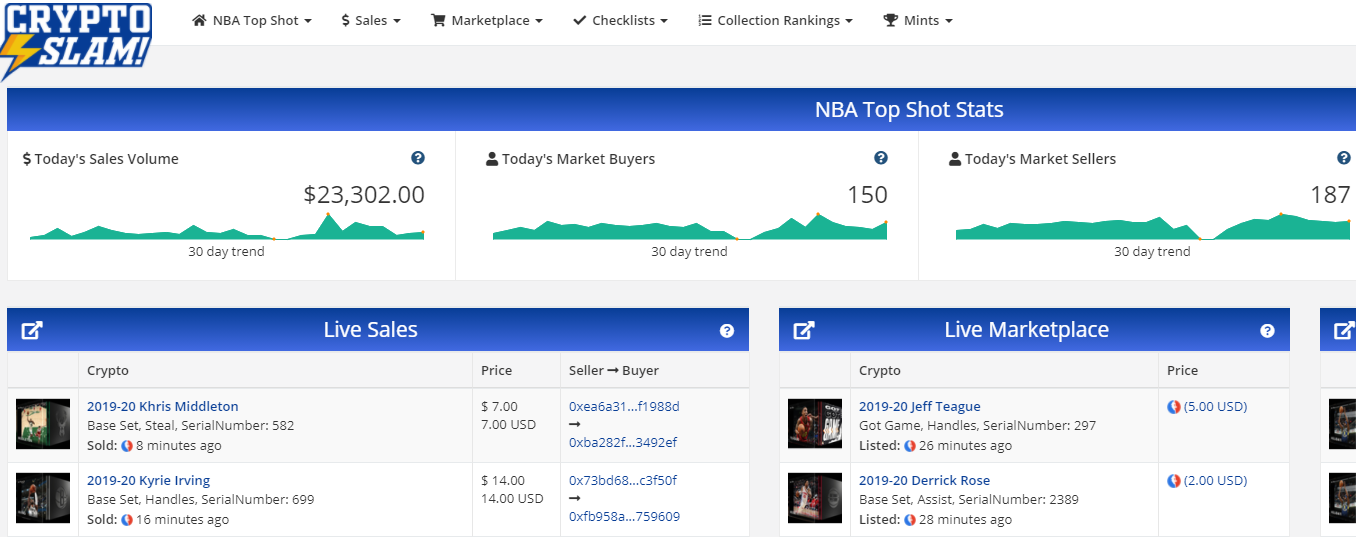

The marketplace does a great job displaying key information around a card’s market value such as the edition size (how many are in print) and the asking price of sellers for the different serial numbers they own.

Last but certainly not least is the “Marketplace” where you can buy and sell individual cards within the site itself. This provides a convenient way to engage with the secondary market, albeit trades incurring a 5% fee that goes to the team. Recently, there’s also been the addition of a “Latest Sales” section that gives you a glimpse of which moments are popular and what kind of prices they’re going for.

Investment Potential

Here at TokenFlipper, we’re huge NBA fans with an extensive history of collecting basketball cards as well as more traditional trading cards. NBA Top Shot, on its surface, ticks all the boxes especially with its high polish, execution and official license as far as matching our interests and expectations. The NBA is a huge global sport with over 1 billion fans spread all across the world and being an official ‘part-owner’ of your favorite players’ most spectacular plays has wide appeal. The age old hobby of collecting sports cards is currently experiencing a renaissance thanks to the promotion by the likes of social media guru Gary Veynercheck and that’s likely to have positive trickle down effects on the burgeoning new field (and logical evolution) that is NFTs and digital collectibles. Dapper Labs has done a great job at hiding the blockchain aspects to the average user whilst still maintaining the provable ownership blockchain element that underpins the whole experience. This combination has the makings of something that can explode into the mainstream and should thus handsomely reward early adopters. Initial indications from the closed beta paint an encouraging picture: 17,000 closed beta users purchased nearly 43,000 packs of NFTs driving more than $2 million in revenue.

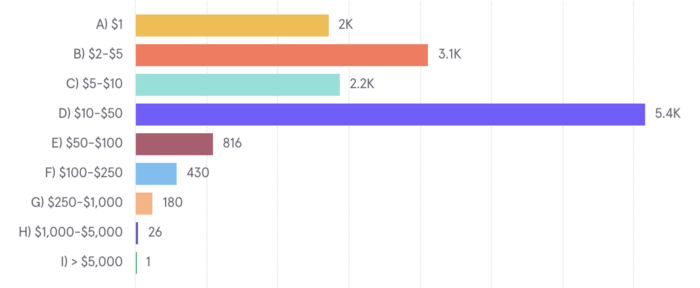

Transaction data released from beta shows that whilst much of the immediate attention might be on big ticket legendary moments, the bulk of the trading activity happens at an affordable price point.

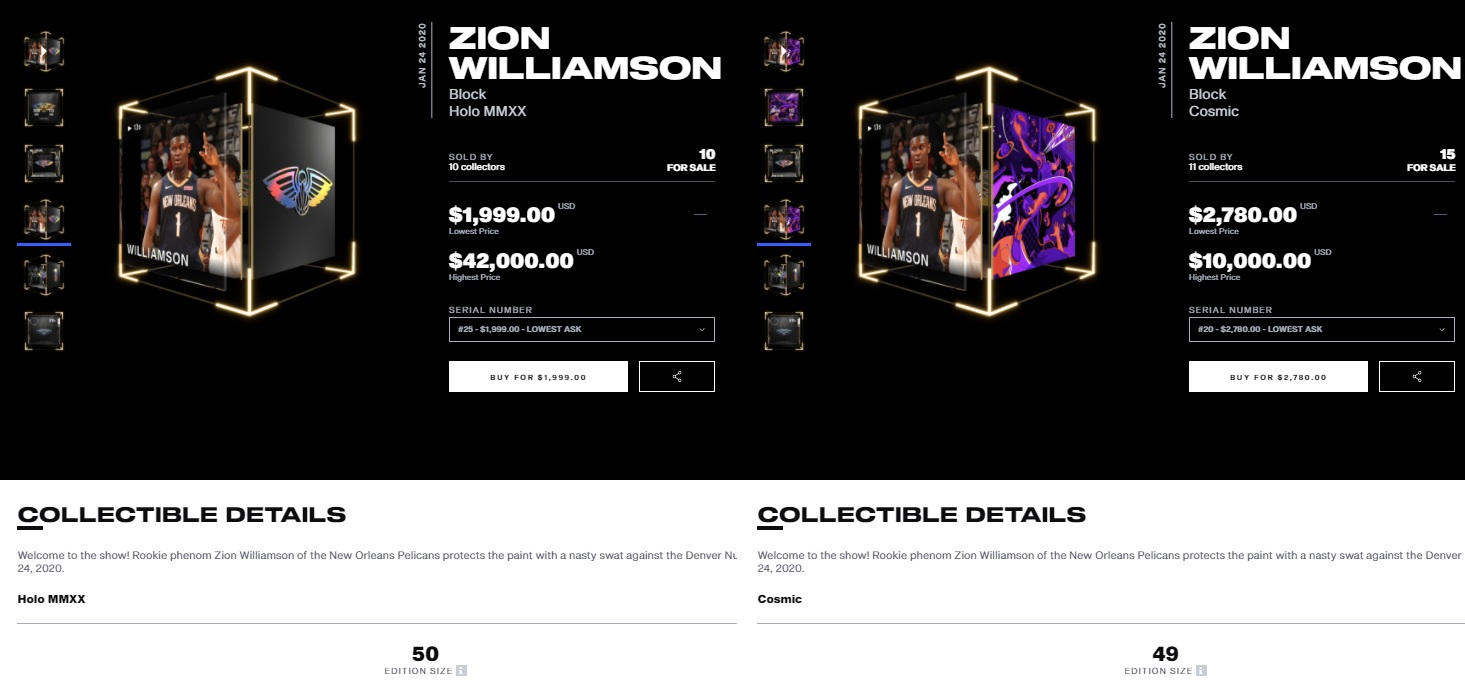

Having said all of that, the project is not without some legitimate concerns. Packs with legendary limited moments (usually limited from 49 to 70 copies in existence and which should be the crown jewels of this collecting experience) are really expensive (sold in $230 packs). The disturbing part in this is that the legendary moments within them are labeled as “Limited Edition” but nothing currently stops the team from printing the same highlight/play in another set. In fact, you can see that this has already transpired with the infamous Zion Williamson rejection against the Nuggets: it has been printed both in the Holo MMXX set (50 of them) and the Cosmic set (49 of them), thus diluting the collection of anyone who thought they were capturing an ultra rare piece of NBA history (and these are sold for thousands of dollars on the secondary market).

(Click to zoom) The two separate moments put side by side. As you can see, there’s not much to distinguish them besides the new set name simply being strapped on.

Putting the same moment in different sets, which are just arbitrary categorizations added for collectability sake, is certainly not enough to justify tarnishing that “Limited Edition” claim put on these cards. The lack of transparency around the schedule, frequency, and nature of set printing also leaves a lot to be desired – making it very difficult to accurately grasp the supply dynamics of the economy. We believe true scarcity and transparent supply are the glues that make the digital collectible NFT magic work and the team’s either disregard or oversight in these matters is a considerable red flag one should consider before putting their hard earned money into this project.

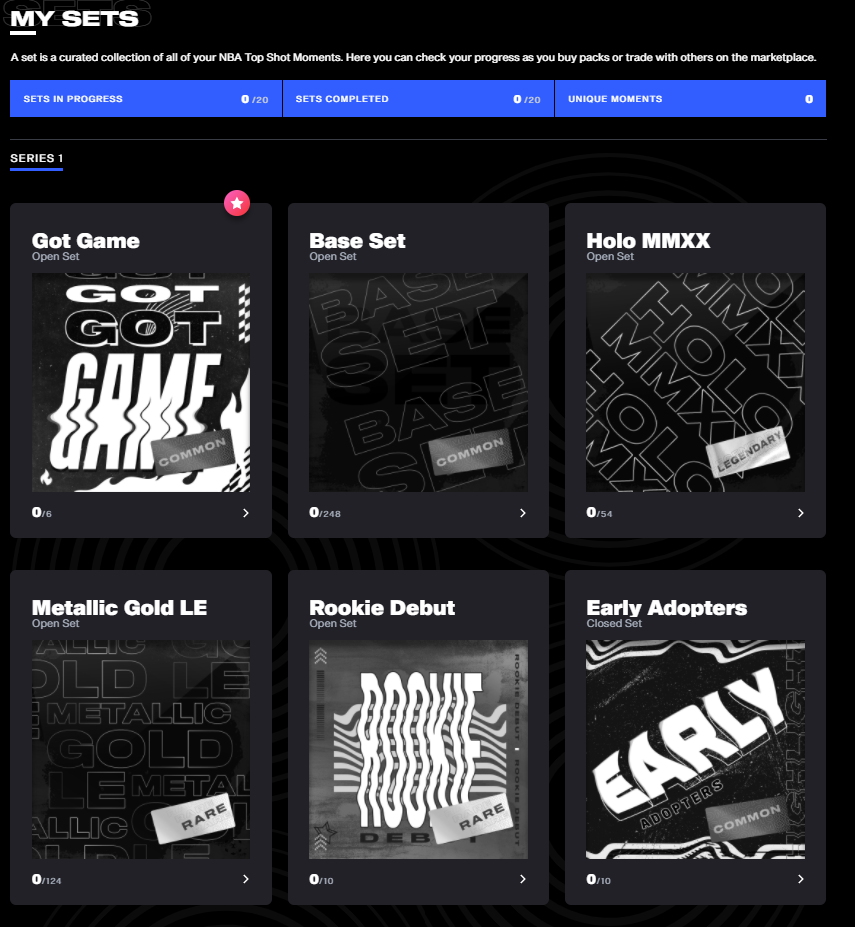

A set is described as a “curated collection” but they’re quite confusing to wrap one’s head around, especially in relation to the different packs, drops, waves, and other terms that the game bombards you with.

Another aspect to consider if you truly believe in the crypto ethos of true ownership is that the moments themselves can’t really be carried outside of the NBA Top Shot website. The NBA is probably not comfortable with their highlights being displayed in any old location and while that might be a legitimate concern for them, it does open the question of what do you really own when you collect these moments and whether these can really be classified as an NFT in the traditional sense of the term.

How To Invest

There is nothing free in NBA Top Shop so the first thing you’ll have to do is top up your account with either crypto or credit card over at the Dapper account page, found in the NBA Top Shop page under “Wallet Balance”. Our initial inclination in these type of collectible opportunities is going for the rarest of items (legendary moments) but the lack of reprint protection as pointed above has made us tentative to follow this approach even if it probably still holds merit. Another popular angle is collecting legendary packs themselves (as opposed to rare and common packs which have much less built-in scarcity) without opening them and keeping them for re-sale at a later date, since the team has recently confirmed trading of packs on the marketplace will soon be enabled. With no announced date however, one might be forced into a longer ‘hodl’ than desired.

You can spend days scouring through the marketplace data to gain insights and make better investment decisions.

For more specific investment approaches, one needs to dip their toes in and really follow the game and community quite closely. Seeing which type of moments and which players are attracting the big bucks may evolve over time and certain trends might occur, such as relatively fringe players like Tyler Herro attracting a cult following and fetching bigger valuations than you might have expected based on their on-court output. Lower serial numbers and serial numbers matching players’ jersey number are at huge premiums but whether they are worth that markup will take more time and data to answer. If you’re really planning to go deep here, highly recommended sources include CryptoSlam and Intangible where there’s more data than you’ll know what to do with. As a collector, speculator, or flipper, this is exactly what you want to be geeking out over. The immediate liquidity at one’s disposal puts NBA Top Shop far ahead of any physical collecting as far as practicality goes and is a firm reminder as to why digital NFTs are the future of collectibles.

If you’d like to learn more about NBA Top Shot, check them out on their official channels: website, Twitter, Discord.

The author as of this writing holds no tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

Blankos Block Party: The First True AAA Blockchain Game?

Published

4 years agoon

October 23, 2020By

TokenFlipper

Since the world’s first encounter with the COVID-19 pandemic, people have naturally been spending an increasing amount of time indoors and by extension spending more time to play video games, leading to significant surges in gaming sales. In these difficult times, our perpetual need for social interaction has not only resulted in the high usage of communication tools like Zoom, but also with simple multiplayer online games with small budgets like Fall Guys and Among Us breaking Twitch viewership records – the latter getting nearly half a million viewers during a broadcast featuring streamer all-stars and the ever popular US Congresswoman Alexandria Ocasio-Cortez. The undeniable success of such interactive party games no doubt makes the present a great time to enter the space and Mythical Games with their title “Blankos Block Party” aims to do just that.

Mythical Games

Mythical Games is a Los-Angeles-based developer that describes itself as “a next generation game technology studio”. Founded in 2018, they have raised $16 million in two rounds of funding in the same year followed by an additional $19 million in November 2019 from a group of Venture firms lead by Javelin Venture Partners and including Galaxy Digital – totaling $35 million in funding. They currently have about 50 employees with an executive team that packs plenty of industry experience having had high-level roles at Activision Blizzard, Electronics Arts, Oculus VR, Zynga, and Telltale Games.

Leveraging their dGoods blockchain technology, Mythical aims to create universal economies driven by player ownership with the core belief of “true ownership of digital assets, verifiable scarcity, and integrated secondary markets are the future of games”. They want to create a platform that provides a suit of services which other developers can use to make their very own player-owned and driven economies around their games. What better way to prove the effectiveness of this model than showing by example, with Blankos Block Party. Here is its first gameplay trailer, released in June:

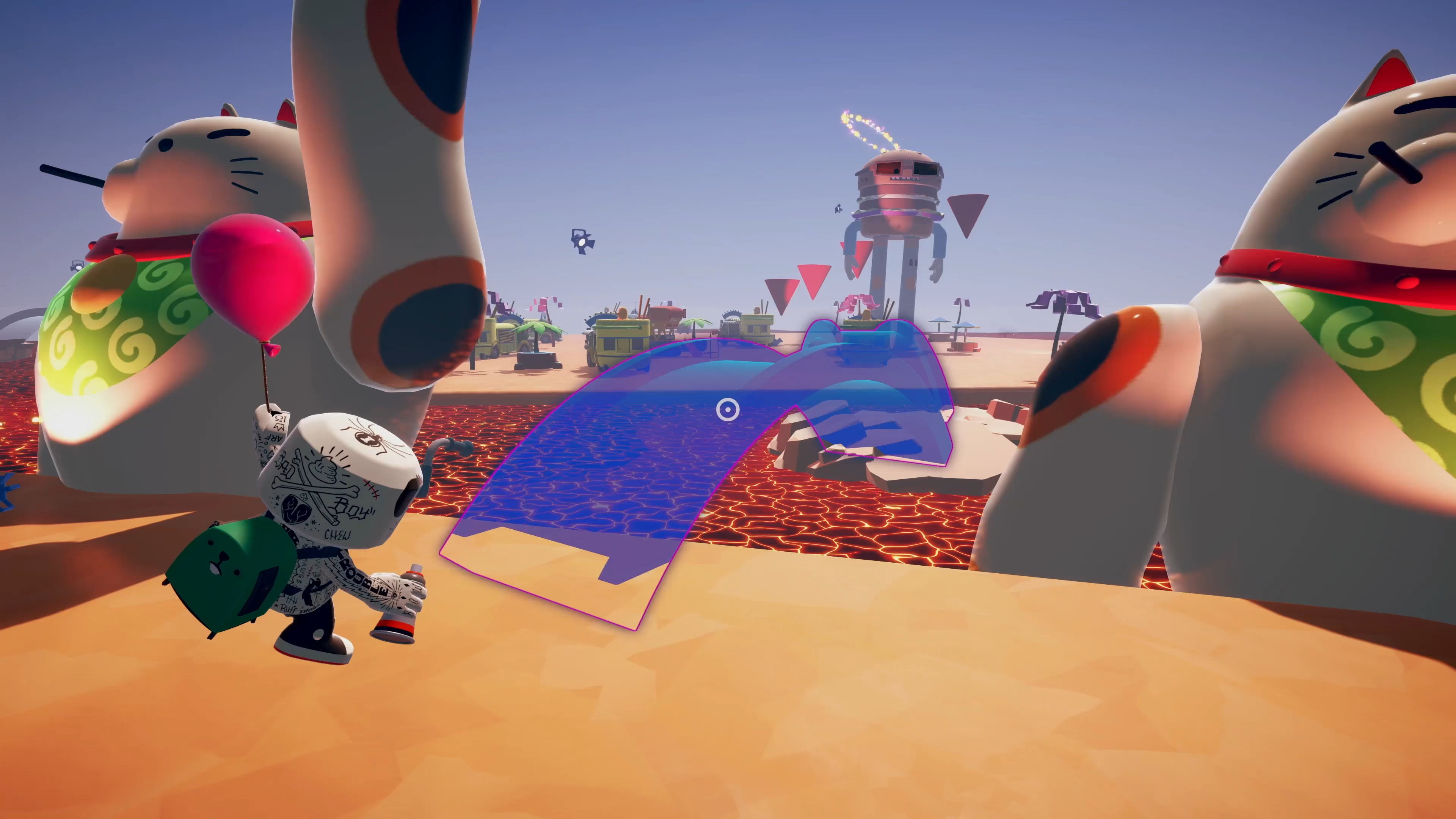

What is Blankos Block Party?

Blankos Block Party is a free-to-play MMO party game set in a vibrant online world styled like a giant block party called ‘The Junction’, with a focus on custom art and design, world-building and exploration, and collecting unique Blankos. Using an ever-expanding array of building items, toys, and accessories, players will be able to design and build various types of single or multiplayer parties that include any combination of shooting, racing, and collection challenges in a user-friendly manner without any coding knowledge. The most popular user-created content will be richly rewarded.

Making your own levels is as easy as clicking a button

At the center of gameplay are of course Blankos, fun and mischievous collectible digital vinyl toy characters each custom designed by talented artists. Players will not only be able to collect and customize their Blankos with different powers and abilities of their choosing as they level up but also make them truly unique with a wide range of skins, accessories, and gear.

The Beta will have dozens of unique Blankos designed by industry-leading artists with more to come

What makes the game stand out as an AAA title and why we cover it: its blockchain elements. Each Blanko as well as other game items are NFTs that will be minted on an EOS private blockchain, where the asset’s security, ownership history, and provable scarcity are established. Players will be able to buy and sell these NFTs for FIAT currencies in the game’s marketplace as well as other trusted blockchain mainnets and marketplaces when those connections are made with time.

Investment Potential

With multiplayer party games’ current popularity and the pandemic not going away anytime soon, this is a good time for Blankos Block Party to enter the market. The game looks polished and fun while the content-creation tools pave the way for unlimited new content. Though EOS isn’t known to be the most decentralized or adopted blockchain, it is more than capable of doing what’s needed from it: providing the NFTs provable ownership. In any case, game development is still very much a centralized proposition so users have no choice but to place their trust in the team – which in this case very much seems like a well-backed competent bunch.

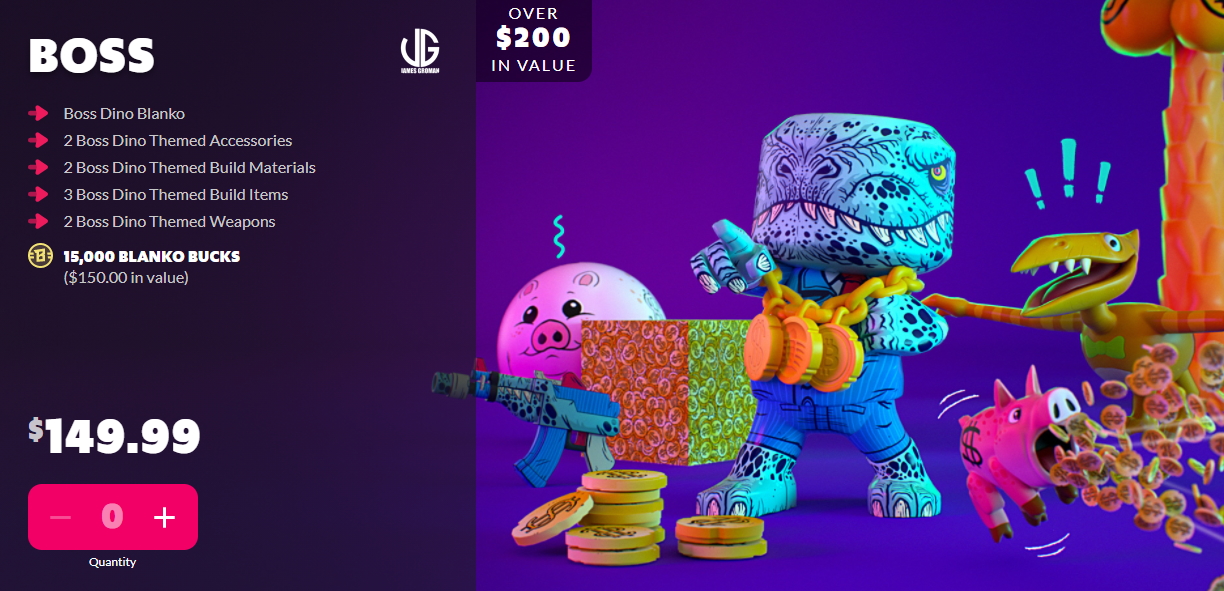

The NFT real-money trading aspect should provide additional incentive to keep people engaged and playing like we’ve never quite seen before in this type of game. The Founders Packs offered are not only limited in supply, potentially making the contents quite scarce and lucrative if the game receives mass adoption like planned, but also offer lots of additional value in the form of Blanko Bucks – the in-game currency with which NFTs can be bought from the game’s own shop.

The 4 types of Founders Pack available in the pre-sale are priced at $150, $100, $50, and $25 respectively.

With that said, the project isn’t beyond reproach. The pre-sale launched with no disclosure of Founder Pack supply limits, without even a time-based cut-off. Not providing this basic level of transparency, which the blockchain could and should easily enable, is confusing to say the least. Furthermore, the marketplace will not launch with the November 17th Closed Beta and is planned for end of 2020/beginning of 2021. This means the NFTs within the Founder’s Packs purchased are trade-locked for at least a few months.

Lastly, the in-game currency Blanco Bucks is not a cryptocurrency and cannot be sold by players in marketplaces – likely due to stringent US regulations – which will inevitably lead to its trade in gray markets (something the devs had specifically mentioned they wanted to avoid with this setup). The game could really stand to gain from a liquid ‘valueless’ ERC20 coin that can be earned and traded to create that important Play To Earn path to draw in the large Free to Play player segment.

How To Invest

At the time of this writing, all Founder Packs are still available on the game’s website. They all offer good value at different price points though bigger investors will likely pull the trigger on the most expensive “Boss Pack” for as much as they are willing to spend.

This may be the first Pack to sell out, if whales have anything to say about it.

If you’d like to learn more about Blankos Block Party, check them out on their official channels: website, Twitter, Discord, Facebook, Instagram, and Youtube.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

Polyient Games: The Ultimate NFT + DeFi Ecosystem?

Published

4 years agoon

October 1, 2020By

TokenFlipper

Probably the hottest trend in crypto since the 2017 ICO boom has been the recent explosion of DeFi and the yield farming / fair launch movement that has come with it. This has opened up a highly profitable and engaging set of composable blocks for agile developers to swiftly put together. While the first wave of that trend seems to be fizzling out, it has no doubt paved the way for more innovation. A particularly interesting topic has now taken over the conversation: the resurgence of NFTs – which had laid dormant since the 2017 CryptoKitties mania. One ambitious project in particular aims to bring the world of NFTs and DeFi together under one umbrella and be the ultimate one-stop shop for everything NFTs, going by the name “Polyient Games”.

Polyient Games

Polyient Games (PG) bills itself as the industry’s first investment firm focused on non-fungible tokens (NFTs) and blockchain gaming. Their parent company Polyient Labs is an early-stage blockchain startup incubator that has made investments into prominent up-and-comers in the space such as NonFungible.com and Cargo.build. With PG, the goal is to make investments into promising and preferably cross-chain blockchain projects that “unlock the full value potential of the non-fungible token (NFT) asset class”. Besides being an incubator and supporting partners with a wide range of services, the team also aims to build their own products and platforms leveraging some of the cutting-edge tech driven by their portfolio companies.

Just a few of the blockchain startups in the Polyient Labs portfolio.

The first of these is a collaborative environment dubbed the Polyient Games Ecosystem (PGE) which aims to bring together a wide array of entities from a range of networks and verticals to collectively take the space to the next level and grow the pie for all involved in what is still a very nascent industry. Luckily for crypto investors wanting to be involved in this exciting environment, Polyient Games recently conducted a sale of tokens that exposes investors to a lot of the cool stuff going on in the ecosystem in the form of the Polyient Games Founders Key (PGFK).

The early PGE partners include some of the biggest blockchain games on the market.

Polyient Games Ecosystem

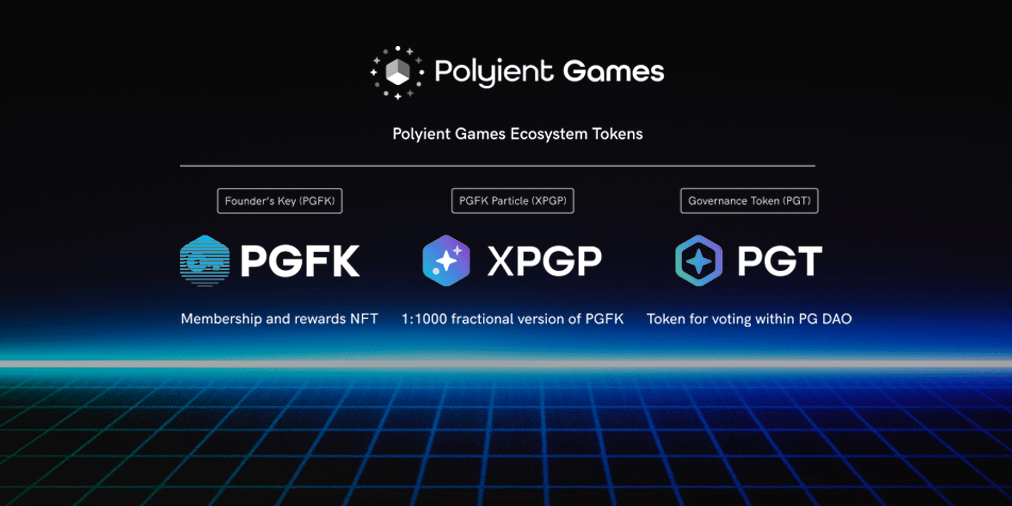

The Polyient Games Ecosystem is powered by the PGFK token and understanding either requires a closer look at the four key pillars that will constitute the PG Ecosystem.

Polyient Games Vault

At its very root, the PGFK token is an ultra-rare NFT enabling holders to gain lifetime rewards and membership to exclusive sections of the PG Ecosystem. The PG Vault is where you can take your PGFK tokens and stake them to earn from a range of rewards including chance based drops (made possible by Chainlink’s VRF – a provably-fair and verifiable source of randomness on-chain) and yield farming rewards coming from a combination of third-party partner token distributions and Polyient Games-specific rewards.

What’s interesting is that the amount of PGFK you hold and their generations (explained later) will serve to amplify your chances at the random drops and improve your farming power. There’s even been talk by the team of earning participation and achievement ‘badges’ that will go towards further boosting yield rates in a gamification layer that serves to seamlessly merge NFT, DeFi, and gaming.

Cargo gems are only the first of a perpetual set of rewards that PGFK holders will receive by simply staking their tokens inside the Vault.

There will be reward airdrops monthly and the first announced reward for PGFK holders is a share of the main utility token for Cargo – a NFT creation and trading platform similar to Rarible. It’s expected that the more the PG ecosystem grows – whether through direct investment by Polyient Games or through projects wanting to join the PG Ecosystem – the larger the potential reward pool will be for PGFK holders.

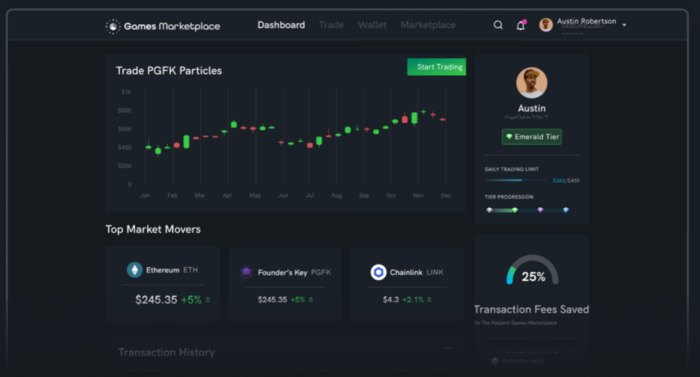

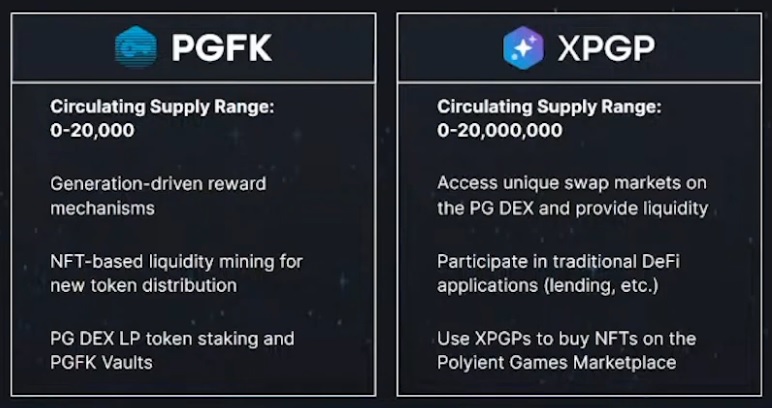

Polyient Games Dex

One of the main products being developed is the Polyient Games DEX. This is a crucial aspect of the ecosystem because it addresses the illiquid state of current NFT projects and those who invest in them. This fungible token exchange will be fueled exclusively by PGFK Particles in a token called XPGP (a utility token that represents a 1:1000 fraction of a PGFK). You will be able to put a PGFK (ERC-721) into the “Particle Bridge”, effectively burning them and receiving in return 1000 XPGP (ERC-20). You can similarly take 1000 XPGP (burn them) and send it through the Bridge to mint 1 PGFK NFT. We noted earlier that PGFK tokens have generations and each time a PGFK is sent through the bridge and deconstructed into XPGPs (or vica versa), the received PGFK or XPGP loses its previous generation number and is minted into a new generation. This thus creates a deflationary aspect for older generations which will favor ‘hodlers’ in PGFK Vault yield farming situations. This organic incentive for early gen0 PGFK holders to keep their NFTs is expected to trickle onto the rest of the ecosystem in terms of removing selling pressure, and ultimately raise prices given demand for either PGFKs or XPGPs grows over time.

It’s coming… 👾 pic.twitter.com/tmRKAU2Lla

— Polyient Games DEX 👾 (@PolyientDEX) September 22, 2020

The Polyient Games DEX will come in two waves – the first version is on the verge of release and will essentially be an adapted Uniswap fork that will quickly get things up and running on the Ethereum network. What’s much more interesting is version 2 that is slated for the end of 2020. V2 is a fast and cheap DEX built on the recently released Avalanche network by Ava Labs on their X-Chain. Combining the widely adopted token standards of Ethereum with the speed and cost of the Avalanche network could be a huge boon for a sector of the market that lives or dies by gas costs, in no small part due to the low-dollar-value of a lot of the transactions that take place. To incentivize liquidity on the XPGP-token pairs, you’ll be able to take your LP token and stake it inside the PGFK vault for further rewards beyond the trading fees generated – similar to what we’ve seen recently become popularized by the likes of Yams and Sushi yield farm projects.

Polyient Games Marketplace

The Marketplace is the wider umbrella under which the PG DEX sits, but it’s important to note it as a separate entity because of what it can potential bring the NFT space. Currently, one of the main problems plaguing the NFT space is a lack of liquidity (especially for the non-fungible tokens that can’t be traded on your usual exchanges) and no central flexible marketplace on which to explore the vast happenings in the space.

An NFT-focused marketplace that solves UX deal-breakers centered around speed and cost currently plaguing the Ethereum network is desperately needed.

The PG marketplace has the potential to be the Steam of NFTs as beside from benefiting from the DEX and the Vault mentioned above, it will be a curated place where traders, investors, liquidity providers will all be interacting with each other. With all the money and eyeballs already locked into the ecosystem, it can serve as a concentrated and integrated platform where new NFTs can be showcased, presales conducted, and auctions can be had. This will naturally depend on how well Polyient Games is able to bring the different players in the wider NFT world together but the incentives are certainly there.

Polyient Games DAO

PGT is the native governance token for the Polyient Games Ecosystem and has been given to all participants in the initial PGFK sale on a 1:1 ratio. While the DAO is not expected to be operational this calendar year, the founding team have made their intentions clear that they plan to migrate the majority of decision making authority to PGT holders over time. Some of the areas under review for decision making migration include:

● PGFK Reward Vault Yields

● PGFK to XPGP conversion ratios

● PG partner participation criteria

● PG DEX rewards for liquidity providers

● Distribution of rewards generated by PG DEX transaction fees

As we’ve seen with many successful projects, the initial build-out by a centralized team to then transition to have the decision making be passed on to the community is a great way to live by the crypto ethos of decentralization as well as better fight any potential future regulations that could more easily target centralized entities.

The three tokens in the ecosystem revolve around reward drops (PGFK), marketplace currency (XPGP), and governance (PGT).

Polyient Games Founders Key (PGFK) Token

The majority of PGFK tokens (12,000 out of total 20,000) were sold during a week-long sale that started on September 15 and sold out just few hours before the September 22 end date. They were sold at a price fixed to 1 PGFK equaling 400 DAI and the only cheaper tokens available were sold at a 20% discount in a presale for 500 PGFK conducted in mid-July. The rest of the 7,500 tokens were divided as follows:

— Partners & Giveaways: 7.26%

— XPGP Liquidity: 66.67%

— Team: 26.07%

As you can probably appreciate when we discussed the PG Ecosystem, the PGFK token is one of the most unique tokens to have hit the crypto scene in quite a while. The dual state in which a non-fungible ERC-721 can fluidly alternate between being a utility token fueling the marketplace side to a rare NFT with MMORPG-like traits that generates a lifetime worth of NFT lootbox-like rewards on the other is quite a fascinating dynamic. Let’s look again at the benefits that have been announced by the team to consider the active token tradeoffs for holders in the ecosystem.

PGFK

● PGFK Holders-only Lobby: PGFK Holders can directly communicate with the Polyient Games team, Ecosystem partners, Games, and other PGFK community members.

● PGFK Member Rank: Given the scarce supply of PGFKs, PG will be leveraging a number of random-chance events to reward holders, including loot box and NFT airdrops.

● Early-Access to the Polyient Games Marketplace

● Polyient Games Marketplace Fee Reductions: All transactions within the Polyient Games Marketplace will include fees that will be collected by Polyient Games to reinvest in the Ecosystem.

○ Early Polyient Games adopters will have the opportunity to reduce and even remove these fees by stacking PGFKs. With the roll-out of the full PG Marketplace, PG will reduce 1% of the transaction fees with each PGFK held in a user’s wallet.

○ Fee reductions will initially be associated with NFT purchases, but it will likely be extended to the PG DEX. This fee will only be factored into Polyient Games’ fees and not transactional fees destined for liquidity pool participants.

● Early-Access to the Polyient Games Particle Bridge: The more PGFKs you hold, the sooner you will have access to the smart contracts necessary to convert them into XPGPs.

● Early-Access to Polyient Games Usernames: The more PGFKs you hold, the sooner you will be able to claim your official Polyient Games Web 3.0 username.

XPGP

● Main transactional unit for all purchases made within the PGE platform.

● Main payment option for NFT pre-sales and auctions conducted within the PGM.

● Main trading pair for all fungible tokens listed on the PG DEX, including Ecosystem member in-game currencies, Polyient-backed token projects, and more.

PGFK Investment Potential

The NFT and DeFi space is moving fast and PGFK seems to be in prime position to capitalize on that trend by taking the focused investment approach of the Polyient Games team and using that to build out a wider ecosystem that will invite both the big developers / creators in the space as well as the technological partners such as Ava Labs and Chainlink to give the whole sector a chance to flourish at scale. While as a PGFK holder you don’t get any equity or direct stake in the companies within the PG portfolio or the wider PG ecosystem, there’s so far been conceited efforts demonstrated by the PG team to see PGFK holders rewarded, whether that’s through direct distribution of the main utility token in the case of Cargo or through the recent investment in Community Games which utilizes their decentralized tournament hosting capabilities to run exclusive tournaments with prizes for PGFK holders.

A look at what’s to come in the near future.

At a $8m fully diluted marketcap during the sale, the project was very competitively-priced when compared to the valuations of platforms such as $MEME which have a much smaller scope on the surface. Of course at the end of the day, it will come down to the execution of the different parts mentioned above and how well they use their position and network to stay ahead of the field by being the one-stop shop for NFTs in combination with the exciting doors that DeFi opens up. It cannot be understated that blockchain games/projects are greatly incentivized to join the PG ecosystem, not only due to instant exposure to a highly targeted and invested userbase but also near-instant liquidity provided by the PG DEX, allowing them to spend their valuable development resources on what they do best: make great products.

Seeing as DeFi and NFTs are the two hottest sectors in crypto right now and will remain so for the foreseeable future, this seems like an exciting ecosystem to be a part of both for developers and investors alike. Whether Polyient Games ends up being the ultimate NFT + DeFi ecosystem as the title questions remains to be seen, but they currently seem to be ahead of the pack in terms of bringing all these concepts together and having a cohesive scalable plan to make it a reality. Even though games and art are the logical kickstarters of today’s NFT ecosystems, anything from the real world can and will eventually be made into NFTs, and a flexible (incentives + marketplace + DEX), cheap (AVAX), and community-driven (DAO) ecosystem has as good of a chance to capture a piece of the much bigger pie of the future as any proposed solutions we have seen to date.

The scope of areas that Polyient Games aims to cover in the future is wide and vast..

How To Invest

Since the sale is over, the only place to get a hold of PGFK tokens is on NFT marketplaces such as OpenSea. The price as of this writing is slightly above the initial sale price but good deals may be found for those willing to wait for sellers in need of fast liquidity.

If you’d like to learn more about Polyient Games, check them out on their official channels: website, Twitter, Discord, and Telegram.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Trending

-

Articles6 years ago

Articles6 years agoGods Unchained Guide: Investing In The First Blockchain TCG

-

Articles4 years ago

Articles4 years agoBlankos Block Party: The First True AAA Blockchain Game?

-

Articles4 years ago

Articles4 years agoNBA Top Shot: The First Mainstream NFTs?

-

Guides6 years ago

Guides6 years agoGuide To Wall Street Interest In Crypto

-

Articles4 years ago

Articles4 years agoPolyient Games: The Ultimate NFT + DeFi Ecosystem?