Articles

Polyient Games: The Ultimate NFT + DeFi Ecosystem?

Published

4 years agoon

By

TokenFlipper

Probably the hottest trend in crypto since the 2017 ICO boom has been the recent explosion of DeFi and the yield farming / fair launch movement that has come with it. This has opened up a highly profitable and engaging set of composable blocks for agile developers to swiftly put together. While the first wave of that trend seems to be fizzling out, it has no doubt paved the way for more innovation. A particularly interesting topic has now taken over the conversation: the resurgence of NFTs – which had laid dormant since the 2017 CryptoKitties mania. One ambitious project in particular aims to bring the world of NFTs and DeFi together under one umbrella and be the ultimate one-stop shop for everything NFTs, going by the name “Polyient Games”.

Polyient Games

Polyient Games (PG) bills itself as the industry’s first investment firm focused on non-fungible tokens (NFTs) and blockchain gaming. Their parent company Polyient Labs is an early-stage blockchain startup incubator that has made investments into prominent up-and-comers in the space such as NonFungible.com and Cargo.build. With PG, the goal is to make investments into promising and preferably cross-chain blockchain projects that “unlock the full value potential of the non-fungible token (NFT) asset class”. Besides being an incubator and supporting partners with a wide range of services, the team also aims to build their own products and platforms leveraging some of the cutting-edge tech driven by their portfolio companies.

Just a few of the blockchain startups in the Polyient Labs portfolio.

The first of these is a collaborative environment dubbed the Polyient Games Ecosystem (PGE) which aims to bring together a wide array of entities from a range of networks and verticals to collectively take the space to the next level and grow the pie for all involved in what is still a very nascent industry. Luckily for crypto investors wanting to be involved in this exciting environment, Polyient Games recently conducted a sale of tokens that exposes investors to a lot of the cool stuff going on in the ecosystem in the form of the Polyient Games Founders Key (PGFK).

The early PGE partners include some of the biggest blockchain games on the market.

Polyient Games Ecosystem

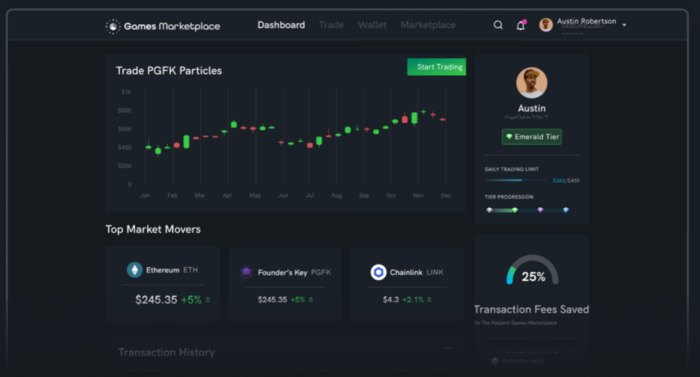

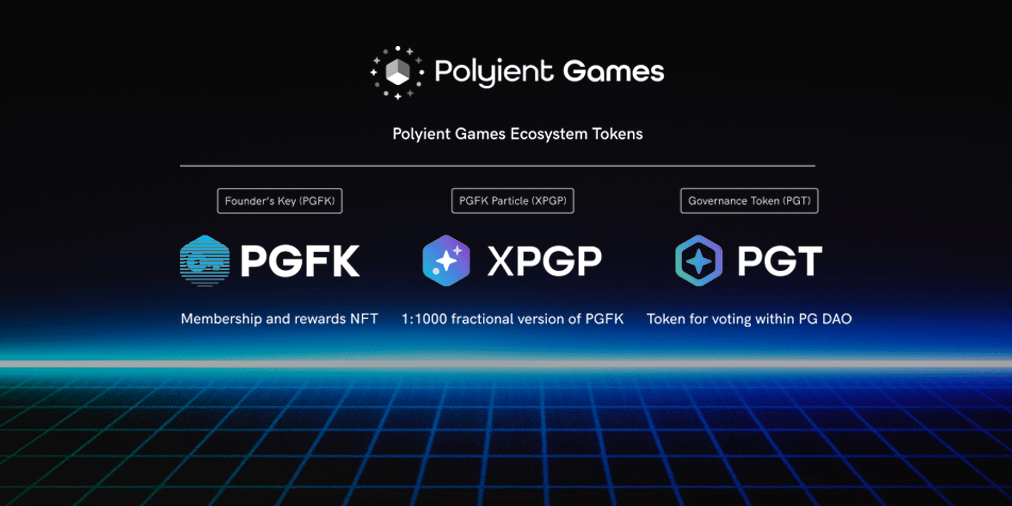

The Polyient Games Ecosystem is powered by the PGFK token and understanding either requires a closer look at the four key pillars that will constitute the PG Ecosystem.

Polyient Games Vault

At its very root, the PGFK token is an ultra-rare NFT enabling holders to gain lifetime rewards and membership to exclusive sections of the PG Ecosystem. The PG Vault is where you can take your PGFK tokens and stake them to earn from a range of rewards including chance based drops (made possible by Chainlink’s VRF – a provably-fair and verifiable source of randomness on-chain) and yield farming rewards coming from a combination of third-party partner token distributions and Polyient Games-specific rewards.

What’s interesting is that the amount of PGFK you hold and their generations (explained later) will serve to amplify your chances at the random drops and improve your farming power. There’s even been talk by the team of earning participation and achievement ‘badges’ that will go towards further boosting yield rates in a gamification layer that serves to seamlessly merge NFT, DeFi, and gaming.

Cargo gems are only the first of a perpetual set of rewards that PGFK holders will receive by simply staking their tokens inside the Vault.

There will be reward airdrops monthly and the first announced reward for PGFK holders is a share of the main utility token for Cargo – a NFT creation and trading platform similar to Rarible. It’s expected that the more the PG ecosystem grows – whether through direct investment by Polyient Games or through projects wanting to join the PG Ecosystem – the larger the potential reward pool will be for PGFK holders.

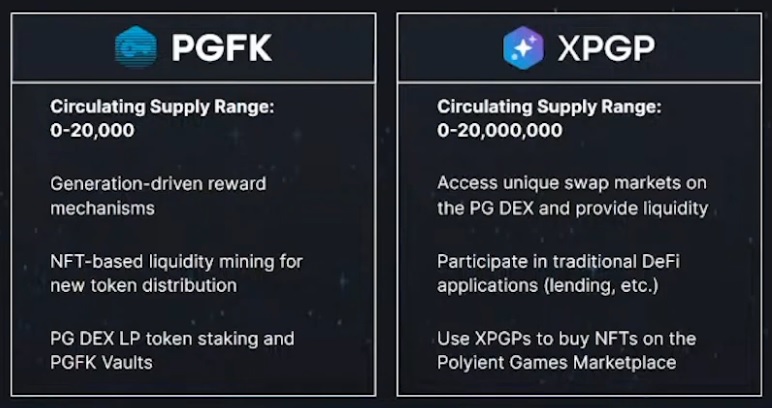

Polyient Games Dex

One of the main products being developed is the Polyient Games DEX. This is a crucial aspect of the ecosystem because it addresses the illiquid state of current NFT projects and those who invest in them. This fungible token exchange will be fueled exclusively by PGFK Particles in a token called XPGP (a utility token that represents a 1:1000 fraction of a PGFK). You will be able to put a PGFK (ERC-721) into the “Particle Bridge”, effectively burning them and receiving in return 1000 XPGP (ERC-20). You can similarly take 1000 XPGP (burn them) and send it through the Bridge to mint 1 PGFK NFT. We noted earlier that PGFK tokens have generations and each time a PGFK is sent through the bridge and deconstructed into XPGPs (or vica versa), the received PGFK or XPGP loses its previous generation number and is minted into a new generation. This thus creates a deflationary aspect for older generations which will favor ‘hodlers’ in PGFK Vault yield farming situations. This organic incentive for early gen0 PGFK holders to keep their NFTs is expected to trickle onto the rest of the ecosystem in terms of removing selling pressure, and ultimately raise prices given demand for either PGFKs or XPGPs grows over time.

It’s coming… 👾 pic.twitter.com/tmRKAU2Lla

— Polyient Games DEX 👾 (@PolyientDEX) September 22, 2020

The Polyient Games DEX will come in two waves – the first version is on the verge of release and will essentially be an adapted Uniswap fork that will quickly get things up and running on the Ethereum network. What’s much more interesting is version 2 that is slated for the end of 2020. V2 is a fast and cheap DEX built on the recently released Avalanche network by Ava Labs on their X-Chain. Combining the widely adopted token standards of Ethereum with the speed and cost of the Avalanche network could be a huge boon for a sector of the market that lives or dies by gas costs, in no small part due to the low-dollar-value of a lot of the transactions that take place. To incentivize liquidity on the XPGP-token pairs, you’ll be able to take your LP token and stake it inside the PGFK vault for further rewards beyond the trading fees generated – similar to what we’ve seen recently become popularized by the likes of Yams and Sushi yield farm projects.

Polyient Games Marketplace

The Marketplace is the wider umbrella under which the PG DEX sits, but it’s important to note it as a separate entity because of what it can potential bring the NFT space. Currently, one of the main problems plaguing the NFT space is a lack of liquidity (especially for the non-fungible tokens that can’t be traded on your usual exchanges) and no central flexible marketplace on which to explore the vast happenings in the space.

An NFT-focused marketplace that solves UX deal-breakers centered around speed and cost currently plaguing the Ethereum network is desperately needed.

The PG marketplace has the potential to be the Steam of NFTs as beside from benefiting from the DEX and the Vault mentioned above, it will be a curated place where traders, investors, liquidity providers will all be interacting with each other. With all the money and eyeballs already locked into the ecosystem, it can serve as a concentrated and integrated platform where new NFTs can be showcased, presales conducted, and auctions can be had. This will naturally depend on how well Polyient Games is able to bring the different players in the wider NFT world together but the incentives are certainly there.

Polyient Games DAO

PGT is the native governance token for the Polyient Games Ecosystem and has been given to all participants in the initial PGFK sale on a 1:1 ratio. While the DAO is not expected to be operational this calendar year, the founding team have made their intentions clear that they plan to migrate the majority of decision making authority to PGT holders over time. Some of the areas under review for decision making migration include:

● PGFK Reward Vault Yields

● PGFK to XPGP conversion ratios

● PG partner participation criteria

● PG DEX rewards for liquidity providers

● Distribution of rewards generated by PG DEX transaction fees

As we’ve seen with many successful projects, the initial build-out by a centralized team to then transition to have the decision making be passed on to the community is a great way to live by the crypto ethos of decentralization as well as better fight any potential future regulations that could more easily target centralized entities.

The three tokens in the ecosystem revolve around reward drops (PGFK), marketplace currency (XPGP), and governance (PGT).

Polyient Games Founders Key (PGFK) Token

The majority of PGFK tokens (12,000 out of total 20,000) were sold during a week-long sale that started on September 15 and sold out just few hours before the September 22 end date. They were sold at a price fixed to 1 PGFK equaling 400 DAI and the only cheaper tokens available were sold at a 20% discount in a presale for 500 PGFK conducted in mid-July. The rest of the 7,500 tokens were divided as follows:

— Partners & Giveaways: 7.26%

— XPGP Liquidity: 66.67%

— Team: 26.07%

As you can probably appreciate when we discussed the PG Ecosystem, the PGFK token is one of the most unique tokens to have hit the crypto scene in quite a while. The dual state in which a non-fungible ERC-721 can fluidly alternate between being a utility token fueling the marketplace side to a rare NFT with MMORPG-like traits that generates a lifetime worth of NFT lootbox-like rewards on the other is quite a fascinating dynamic. Let’s look again at the benefits that have been announced by the team to consider the active token tradeoffs for holders in the ecosystem.

PGFK

● PGFK Holders-only Lobby: PGFK Holders can directly communicate with the Polyient Games team, Ecosystem partners, Games, and other PGFK community members.

● PGFK Member Rank: Given the scarce supply of PGFKs, PG will be leveraging a number of random-chance events to reward holders, including loot box and NFT airdrops.

● Early-Access to the Polyient Games Marketplace

● Polyient Games Marketplace Fee Reductions: All transactions within the Polyient Games Marketplace will include fees that will be collected by Polyient Games to reinvest in the Ecosystem.

○ Early Polyient Games adopters will have the opportunity to reduce and even remove these fees by stacking PGFKs. With the roll-out of the full PG Marketplace, PG will reduce 1% of the transaction fees with each PGFK held in a user’s wallet.

○ Fee reductions will initially be associated with NFT purchases, but it will likely be extended to the PG DEX. This fee will only be factored into Polyient Games’ fees and not transactional fees destined for liquidity pool participants.

● Early-Access to the Polyient Games Particle Bridge: The more PGFKs you hold, the sooner you will have access to the smart contracts necessary to convert them into XPGPs.

● Early-Access to Polyient Games Usernames: The more PGFKs you hold, the sooner you will be able to claim your official Polyient Games Web 3.0 username.

XPGP

● Main transactional unit for all purchases made within the PGE platform.

● Main payment option for NFT pre-sales and auctions conducted within the PGM.

● Main trading pair for all fungible tokens listed on the PG DEX, including Ecosystem member in-game currencies, Polyient-backed token projects, and more.

PGFK Investment Potential

The NFT and DeFi space is moving fast and PGFK seems to be in prime position to capitalize on that trend by taking the focused investment approach of the Polyient Games team and using that to build out a wider ecosystem that will invite both the big developers / creators in the space as well as the technological partners such as Ava Labs and Chainlink to give the whole sector a chance to flourish at scale. While as a PGFK holder you don’t get any equity or direct stake in the companies within the PG portfolio or the wider PG ecosystem, there’s so far been conceited efforts demonstrated by the PG team to see PGFK holders rewarded, whether that’s through direct distribution of the main utility token in the case of Cargo or through the recent investment in Community Games which utilizes their decentralized tournament hosting capabilities to run exclusive tournaments with prizes for PGFK holders.

A look at what’s to come in the near future.

At a $8m fully diluted marketcap during the sale, the project was very competitively-priced when compared to the valuations of platforms such as $MEME which have a much smaller scope on the surface. Of course at the end of the day, it will come down to the execution of the different parts mentioned above and how well they use their position and network to stay ahead of the field by being the one-stop shop for NFTs in combination with the exciting doors that DeFi opens up. It cannot be understated that blockchain games/projects are greatly incentivized to join the PG ecosystem, not only due to instant exposure to a highly targeted and invested userbase but also near-instant liquidity provided by the PG DEX, allowing them to spend their valuable development resources on what they do best: make great products.

Seeing as DeFi and NFTs are the two hottest sectors in crypto right now and will remain so for the foreseeable future, this seems like an exciting ecosystem to be a part of both for developers and investors alike. Whether Polyient Games ends up being the ultimate NFT + DeFi ecosystem as the title questions remains to be seen, but they currently seem to be ahead of the pack in terms of bringing all these concepts together and having a cohesive scalable plan to make it a reality. Even though games and art are the logical kickstarters of today’s NFT ecosystems, anything from the real world can and will eventually be made into NFTs, and a flexible (incentives + marketplace + DEX), cheap (AVAX), and community-driven (DAO) ecosystem has as good of a chance to capture a piece of the much bigger pie of the future as any proposed solutions we have seen to date.

The scope of areas that Polyient Games aims to cover in the future is wide and vast..

How To Invest

Since the sale is over, the only place to get a hold of PGFK tokens is on NFT marketplaces such as OpenSea. The price as of this writing is slightly above the initial sale price but good deals may be found for those willing to wait for sellers in need of fast liquidity.

If you’d like to learn more about Polyient Games, check them out on their official channels: website, Twitter, Discord, and Telegram.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

NBA Top Shot: The First Mainstream NFTs?

Published

4 years agoon

October 27, 2020By

TokenFlipper

Anyone familiar with the world of NFTs will have heard of Cryptokitties and their creator Dapper Labs (formerly Axiom Zen). While the game is still going strong among its core following, outside factors like the congestion on the Ethereum network prevented the cute cat collecting game from ever going mainstream in 2017 in a way it perhaps could have. The folks at Dapper Labs haven’t sat by sulking at the state of things however, and instead elected to take matters into their own hands. They have developed a completely new blockchain dedicated to gaming, entertainment and collectibles, called Flow, launching with a flagship product: NBA Top Shot. Will NBA Top Shot be the experience that takes NFT ownership to finally go full mainstream?

Who’s Behind NBA Top Shot?

With its surprise explosion in popularity in 2017, Cryptokitties opened the eye of many collectors and gamers alike at the possibilities of the blockchain technology. On the back of this success, Cryptokitties was spun off into its own company called Dapper Labs. They’ve received north of $50 million in funding over the years and have formed strong partnerships, both due to their previous successes but also because of their future plans with Flow attracting major partners such as Samsung, Google Ventures, Andreessen Horowitz, Union Square Ventures, Coinbase Ventures just to name a few.

The Flow blockchain is not only attracting big investors, but also some of the biggest brands in the world.

The NBA Top Shot game meanwhile has scored an official NBA license and was designed in partnership with the NBA and the NBA Players Association. Investors in the project include players like Andre Iguodala, Spencer Dinwiddie, Aaron Gordon, JaVale McGee, and Garrett Temple. This, folks, is as legit as they come in the world of crypto.

What Is NBA Top Shot?

NBA Top Shot offers an interesting opportunity: “for the first time ever, NBA fans can truly own a piece of the action — and trade with friends for real money in a new kind of hoops economy.” But you might be asking yourself how does this really work . Essentially, every new real-world NBA highlight is broken down into individual moments and turned into rare video collectibles with limited supply on the blockchain.

Video showing pack opening and how an individual moment collectible looks like.

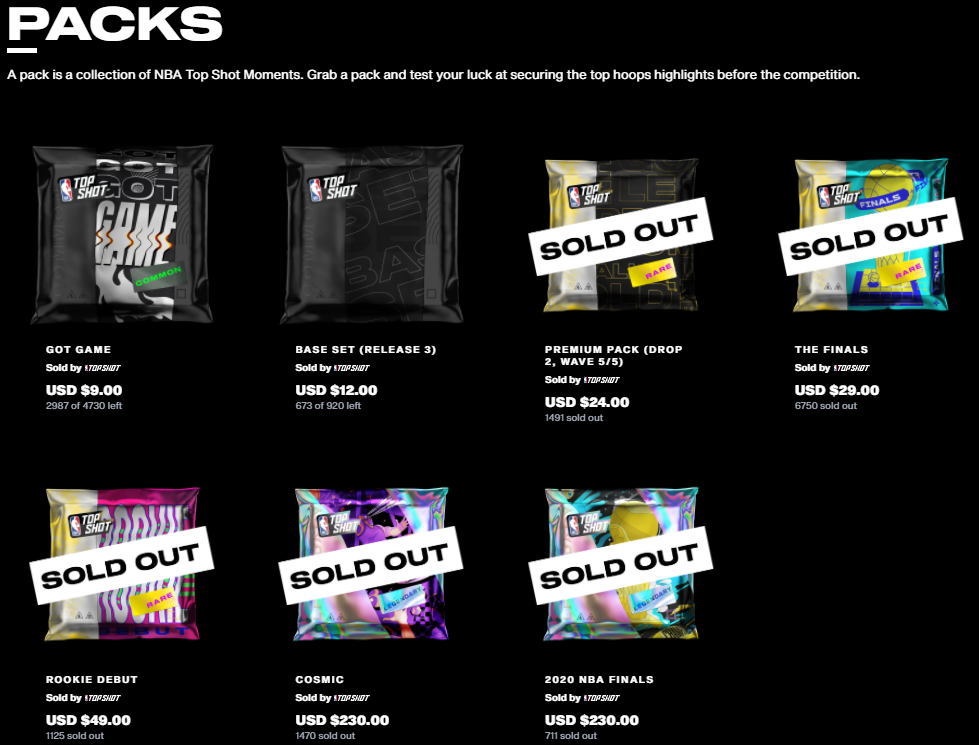

Packs that contain these highlights are sold in limited numbers, and extra layers of collectability are added in the form of rarity (changes the border of the video highlight box presenting the highlight/card itself each with different scarcities) and the random serial number which is the unique mint number within the overall edition size (for example being #1 out of a print of 50 would give it quite a big premium).

Even in digital form, there’s few things more satisfying than cracking open a pack. Securing one of the limited time and quantity packs gives an extra dose of adrenaline.

Game, Collectible, or Something Else?

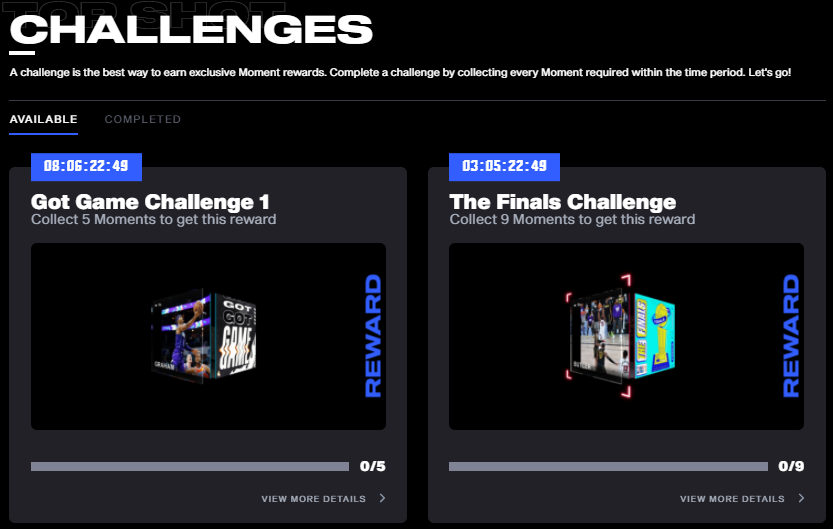

So there are these NBA highlights you can buy from packs and collect – but what else can you really do with them? Currently, the main attraction for early adopters are the limited-time Challenges that are generated by the NBA Top Shot team. These are a type of quest where you are asked to own a specific set of cards by a certain deadline and are rewarded with an exclusive moment that’s only generated through these specific challenges.

Time-limited challenges with exclusive rewards appear from time to time to incentivize completionists to either purchase lots of packs or to use the marketplace to shore up gaps in their collection.

Another section which rewards you, at least socially, for filling out your collection is the “My Showcases” section. Here you can put together your favorite moments to create a chained highlight reel or simply show off some of your most prized collectibles. For example, one user has a showcase of all #1 serial number legendaries owned – something that would certainly cater to the hardcore collector / whale demographic of this experience. For those putting a bigger premium on utility, a mobile game that will let you use your moments is currently being worked on, though details on that are still scarce.

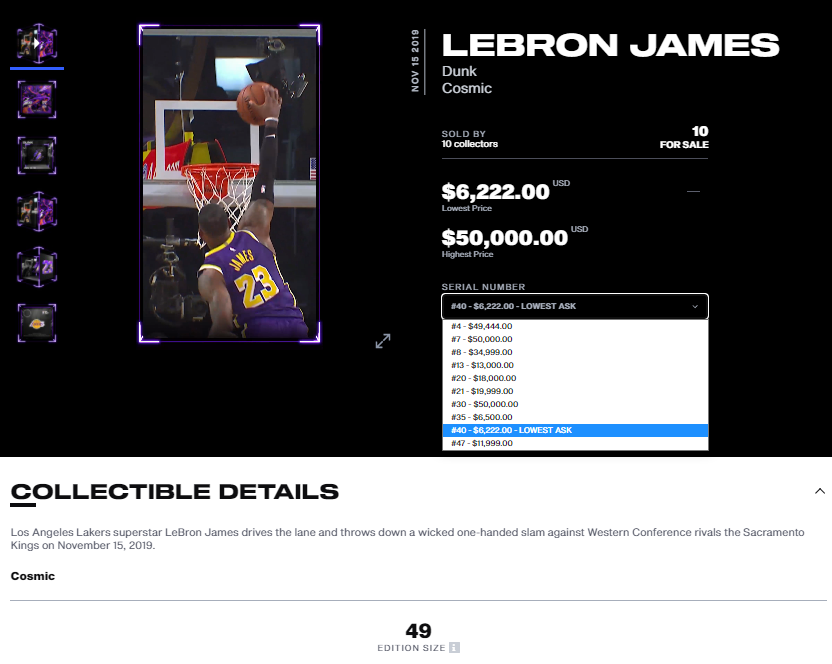

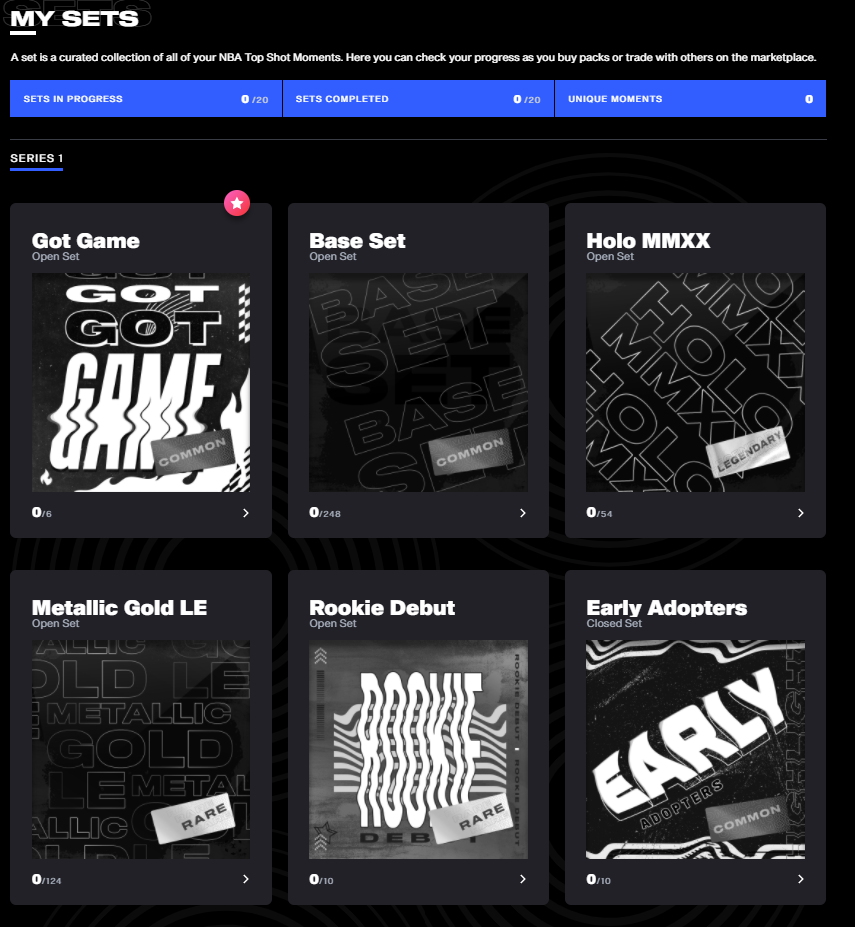

The marketplace does a great job displaying key information around a card’s market value such as the edition size (how many are in print) and the asking price of sellers for the different serial numbers they own.

Last but certainly not least is the “Marketplace” where you can buy and sell individual cards within the site itself. This provides a convenient way to engage with the secondary market, albeit trades incurring a 5% fee that goes to the team. Recently, there’s also been the addition of a “Latest Sales” section that gives you a glimpse of which moments are popular and what kind of prices they’re going for.

Investment Potential

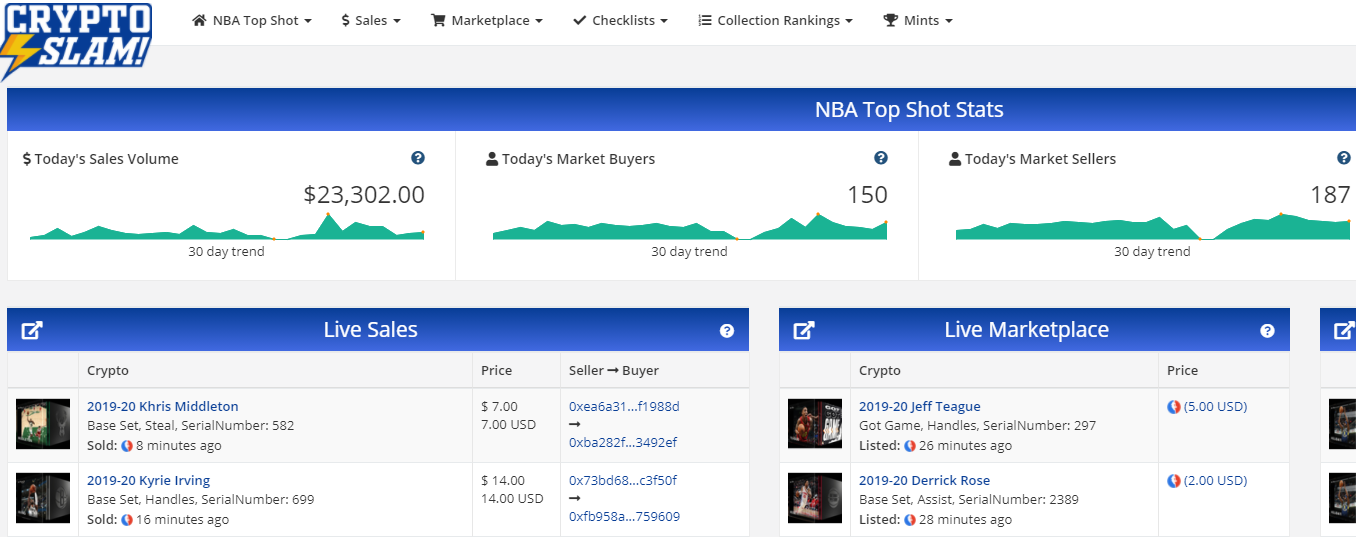

Here at TokenFlipper, we’re huge NBA fans with an extensive history of collecting basketball cards as well as more traditional trading cards. NBA Top Shot, on its surface, ticks all the boxes especially with its high polish, execution and official license as far as matching our interests and expectations. The NBA is a huge global sport with over 1 billion fans spread all across the world and being an official ‘part-owner’ of your favorite players’ most spectacular plays has wide appeal. The age old hobby of collecting sports cards is currently experiencing a renaissance thanks to the promotion by the likes of social media guru Gary Veynercheck and that’s likely to have positive trickle down effects on the burgeoning new field (and logical evolution) that is NFTs and digital collectibles. Dapper Labs has done a great job at hiding the blockchain aspects to the average user whilst still maintaining the provable ownership blockchain element that underpins the whole experience. This combination has the makings of something that can explode into the mainstream and should thus handsomely reward early adopters. Initial indications from the closed beta paint an encouraging picture: 17,000 closed beta users purchased nearly 43,000 packs of NFTs driving more than $2 million in revenue.

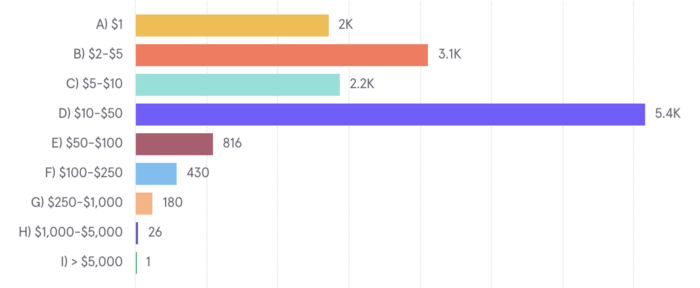

Transaction data released from beta shows that whilst much of the immediate attention might be on big ticket legendary moments, the bulk of the trading activity happens at an affordable price point.

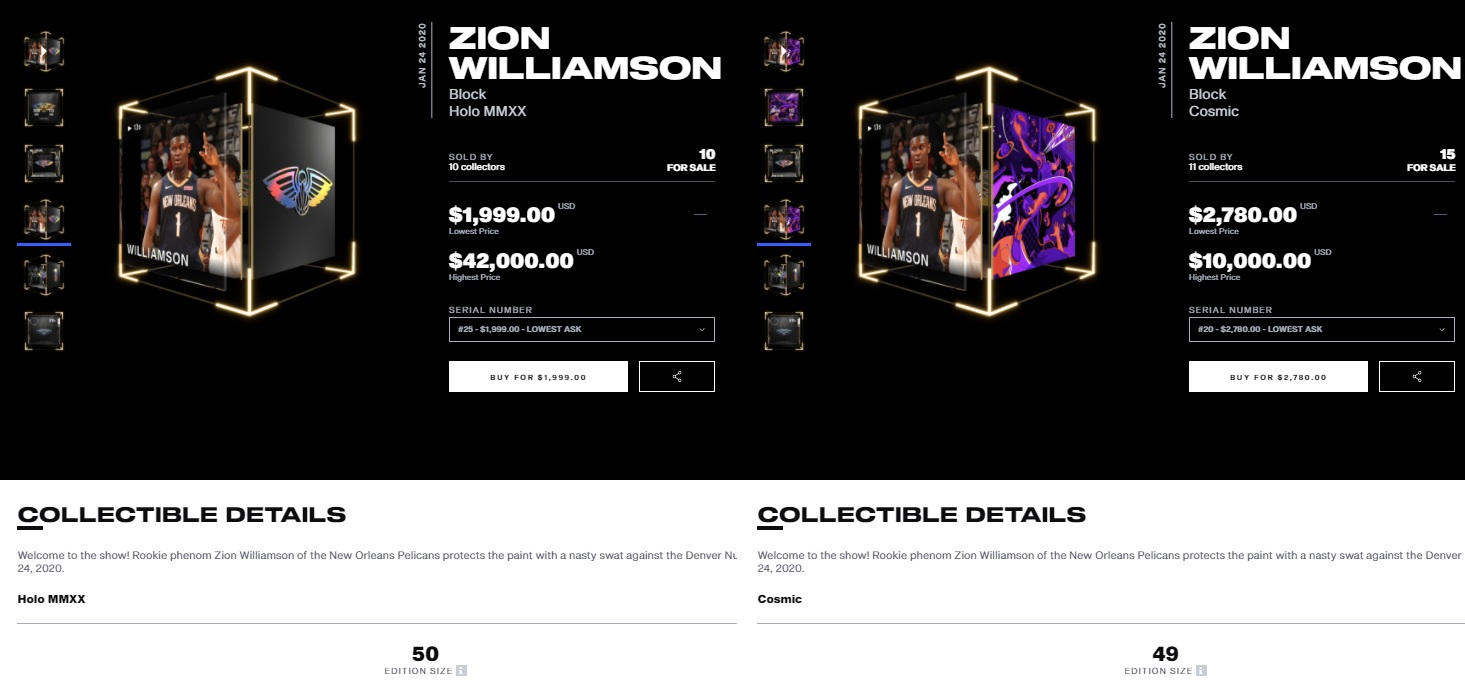

Having said all of that, the project is not without some legitimate concerns. Packs with legendary limited moments (usually limited from 49 to 70 copies in existence and which should be the crown jewels of this collecting experience) are really expensive (sold in $230 packs). The disturbing part in this is that the legendary moments within them are labeled as “Limited Edition” but nothing currently stops the team from printing the same highlight/play in another set. In fact, you can see that this has already transpired with the infamous Zion Williamson rejection against the Nuggets: it has been printed both in the Holo MMXX set (50 of them) and the Cosmic set (49 of them), thus diluting the collection of anyone who thought they were capturing an ultra rare piece of NBA history (and these are sold for thousands of dollars on the secondary market).

(Click to zoom) The two separate moments put side by side. As you can see, there’s not much to distinguish them besides the new set name simply being strapped on.

Putting the same moment in different sets, which are just arbitrary categorizations added for collectability sake, is certainly not enough to justify tarnishing that “Limited Edition” claim put on these cards. The lack of transparency around the schedule, frequency, and nature of set printing also leaves a lot to be desired – making it very difficult to accurately grasp the supply dynamics of the economy. We believe true scarcity and transparent supply are the glues that make the digital collectible NFT magic work and the team’s either disregard or oversight in these matters is a considerable red flag one should consider before putting their hard earned money into this project.

A set is described as a “curated collection” but they’re quite confusing to wrap one’s head around, especially in relation to the different packs, drops, waves, and other terms that the game bombards you with.

Another aspect to consider if you truly believe in the crypto ethos of true ownership is that the moments themselves can’t really be carried outside of the NBA Top Shot website. The NBA is probably not comfortable with their highlights being displayed in any old location and while that might be a legitimate concern for them, it does open the question of what do you really own when you collect these moments and whether these can really be classified as an NFT in the traditional sense of the term.

How To Invest

There is nothing free in NBA Top Shop so the first thing you’ll have to do is top up your account with either crypto or credit card over at the Dapper account page, found in the NBA Top Shop page under “Wallet Balance”. Our initial inclination in these type of collectible opportunities is going for the rarest of items (legendary moments) but the lack of reprint protection as pointed above has made us tentative to follow this approach even if it probably still holds merit. Another popular angle is collecting legendary packs themselves (as opposed to rare and common packs which have much less built-in scarcity) without opening them and keeping them for re-sale at a later date, since the team has recently confirmed trading of packs on the marketplace will soon be enabled. With no announced date however, one might be forced into a longer ‘hodl’ than desired.

You can spend days scouring through the marketplace data to gain insights and make better investment decisions.

For more specific investment approaches, one needs to dip their toes in and really follow the game and community quite closely. Seeing which type of moments and which players are attracting the big bucks may evolve over time and certain trends might occur, such as relatively fringe players like Tyler Herro attracting a cult following and fetching bigger valuations than you might have expected based on their on-court output. Lower serial numbers and serial numbers matching players’ jersey number are at huge premiums but whether they are worth that markup will take more time and data to answer. If you’re really planning to go deep here, highly recommended sources include CryptoSlam and Intangible where there’s more data than you’ll know what to do with. As a collector, speculator, or flipper, this is exactly what you want to be geeking out over. The immediate liquidity at one’s disposal puts NBA Top Shop far ahead of any physical collecting as far as practicality goes and is a firm reminder as to why digital NFTs are the future of collectibles.

If you’d like to learn more about NBA Top Shot, check them out on their official channels: website, Twitter, Discord.

The author as of this writing holds no tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

Blankos Block Party: The First True AAA Blockchain Game?

Published

4 years agoon

October 23, 2020By

TokenFlipper

Since the world’s first encounter with the COVID-19 pandemic, people have naturally been spending an increasing amount of time indoors and by extension spending more time to play video games, leading to significant surges in gaming sales. In these difficult times, our perpetual need for social interaction has not only resulted in the high usage of communication tools like Zoom, but also with simple multiplayer online games with small budgets like Fall Guys and Among Us breaking Twitch viewership records – the latter getting nearly half a million viewers during a broadcast featuring streamer all-stars and the ever popular US Congresswoman Alexandria Ocasio-Cortez. The undeniable success of such interactive party games no doubt makes the present a great time to enter the space and Mythical Games with their title “Blankos Block Party” aims to do just that.

Mythical Games

Mythical Games is a Los-Angeles-based developer that describes itself as “a next generation game technology studio”. Founded in 2018, they have raised $16 million in two rounds of funding in the same year followed by an additional $19 million in November 2019 from a group of Venture firms lead by Javelin Venture Partners and including Galaxy Digital – totaling $35 million in funding. They currently have about 50 employees with an executive team that packs plenty of industry experience having had high-level roles at Activision Blizzard, Electronics Arts, Oculus VR, Zynga, and Telltale Games.

Leveraging their dGoods blockchain technology, Mythical aims to create universal economies driven by player ownership with the core belief of “true ownership of digital assets, verifiable scarcity, and integrated secondary markets are the future of games”. They want to create a platform that provides a suit of services which other developers can use to make their very own player-owned and driven economies around their games. What better way to prove the effectiveness of this model than showing by example, with Blankos Block Party. Here is its first gameplay trailer, released in June:

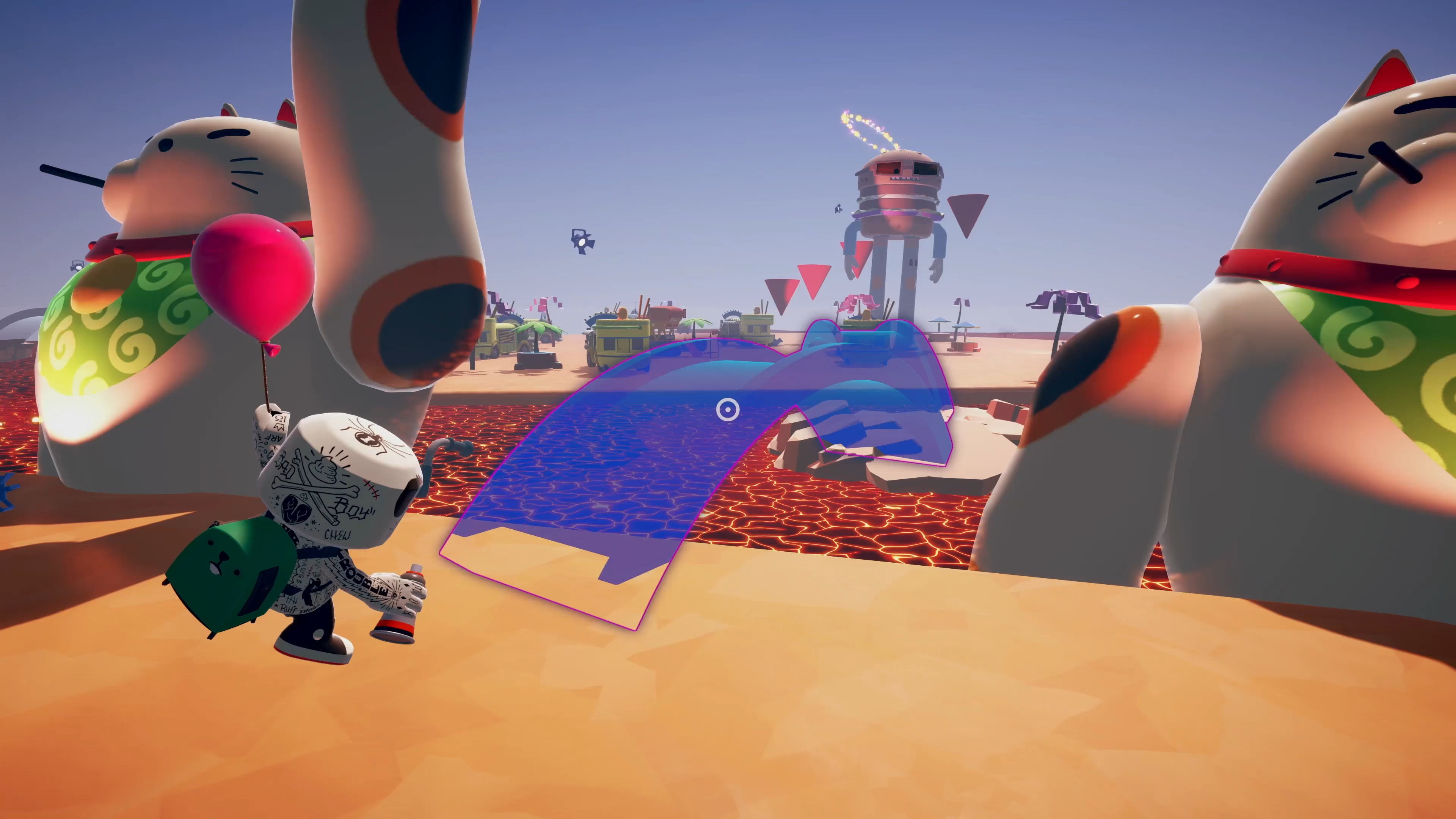

What is Blankos Block Party?

Blankos Block Party is a free-to-play MMO party game set in a vibrant online world styled like a giant block party called ‘The Junction’, with a focus on custom art and design, world-building and exploration, and collecting unique Blankos. Using an ever-expanding array of building items, toys, and accessories, players will be able to design and build various types of single or multiplayer parties that include any combination of shooting, racing, and collection challenges in a user-friendly manner without any coding knowledge. The most popular user-created content will be richly rewarded.

Making your own levels is as easy as clicking a button

At the center of gameplay are of course Blankos, fun and mischievous collectible digital vinyl toy characters each custom designed by talented artists. Players will not only be able to collect and customize their Blankos with different powers and abilities of their choosing as they level up but also make them truly unique with a wide range of skins, accessories, and gear.

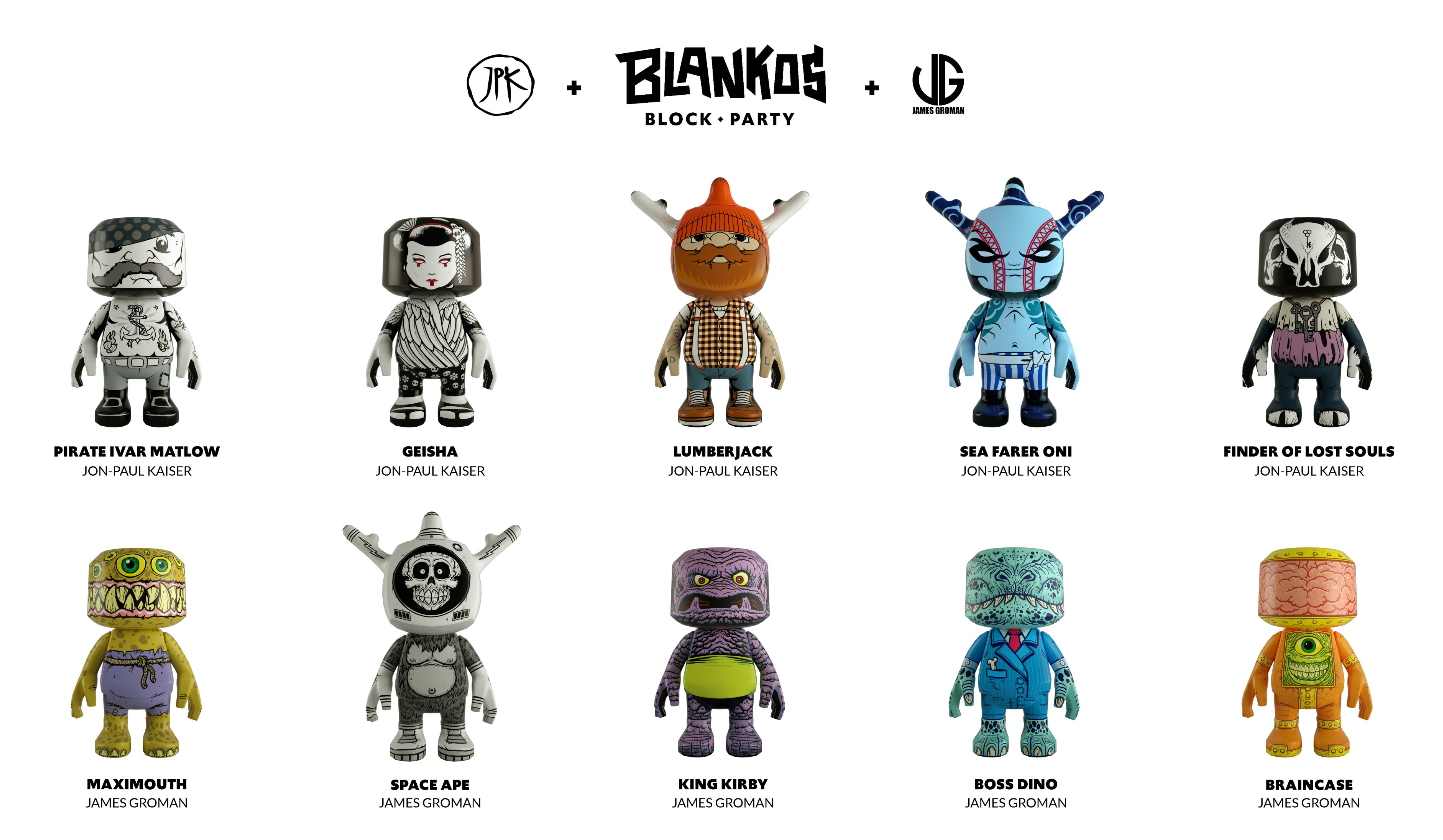

The Beta will have dozens of unique Blankos designed by industry-leading artists with more to come

What makes the game stand out as an AAA title and why we cover it: its blockchain elements. Each Blanko as well as other game items are NFTs that will be minted on an EOS private blockchain, where the asset’s security, ownership history, and provable scarcity are established. Players will be able to buy and sell these NFTs for FIAT currencies in the game’s marketplace as well as other trusted blockchain mainnets and marketplaces when those connections are made with time.

Investment Potential

With multiplayer party games’ current popularity and the pandemic not going away anytime soon, this is a good time for Blankos Block Party to enter the market. The game looks polished and fun while the content-creation tools pave the way for unlimited new content. Though EOS isn’t known to be the most decentralized or adopted blockchain, it is more than capable of doing what’s needed from it: providing the NFTs provable ownership. In any case, game development is still very much a centralized proposition so users have no choice but to place their trust in the team – which in this case very much seems like a well-backed competent bunch.

The NFT real-money trading aspect should provide additional incentive to keep people engaged and playing like we’ve never quite seen before in this type of game. The Founders Packs offered are not only limited in supply, potentially making the contents quite scarce and lucrative if the game receives mass adoption like planned, but also offer lots of additional value in the form of Blanko Bucks – the in-game currency with which NFTs can be bought from the game’s own shop.

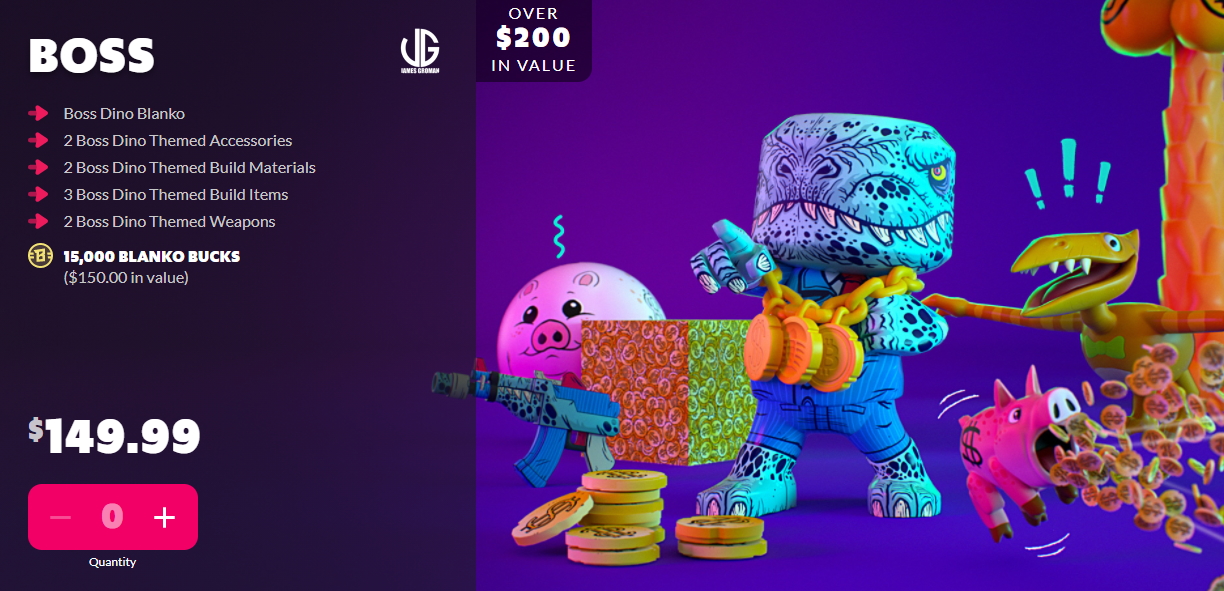

The 4 types of Founders Pack available in the pre-sale are priced at $150, $100, $50, and $25 respectively.

With that said, the project isn’t beyond reproach. The pre-sale launched with no disclosure of Founder Pack supply limits, without even a time-based cut-off. Not providing this basic level of transparency, which the blockchain could and should easily enable, is confusing to say the least. Furthermore, the marketplace will not launch with the November 17th Closed Beta and is planned for end of 2020/beginning of 2021. This means the NFTs within the Founder’s Packs purchased are trade-locked for at least a few months.

Lastly, the in-game currency Blanco Bucks is not a cryptocurrency and cannot be sold by players in marketplaces – likely due to stringent US regulations – which will inevitably lead to its trade in gray markets (something the devs had specifically mentioned they wanted to avoid with this setup). The game could really stand to gain from a liquid ‘valueless’ ERC20 coin that can be earned and traded to create that important Play To Earn path to draw in the large Free to Play player segment.

How To Invest

At the time of this writing, all Founder Packs are still available on the game’s website. They all offer good value at different price points though bigger investors will likely pull the trigger on the most expensive “Boss Pack” for as much as they are willing to spend.

This may be the first Pack to sell out, if whales have anything to say about it.

If you’d like to learn more about Blankos Block Party, check them out on their official channels: website, Twitter, Discord, Facebook, Instagram, and Youtube.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Guides

Guide To Wall Street Interest In Crypto

Published

6 years agoon

October 15, 2018By

TokenFlipper

It wasn’t too long ago that Bitcoin and cryptos were largely frowned upon, seen as a tool only relevant to terrorists and drug dealers. But 2018 has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing around regulatory uncertainty and react to the surge in demand from their clients.

It’s no secret that fresh capital and demand is needed to take the crypto market to new highs, and thus everyone has been wondering where the institutional demand will come from and which large companies will lay the groundwork to allow this on-ramp to happen. Below we present the key actors that are starting to make moves and could serve as catalysts to drive demand upwards.

Assets Under Management: $2.8 Trillion

JPMorgan Chase

JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. The bank’s Blockchain Center of Excellence department developed in conjunction with the Ethereum Enterprise Alliance a project called Quorum, which is currently branded as an “enterprise-focused version of Ethereum”. In March 2018 JP Morgan announced that in light of the platforms popularity and potential, they were considering spinning it off as a separate entity. This is just one of the enterprise platforms that they’re working on and JPM has continuously been at the forefront of financial firms seeking to patent blockchain based securities services.

Even JP Morgan CEO Jamie Dimon who grabbed headlines in September of 2017, when he slammed Bitcoin as a fraud and pretty much threatened anyone in his company they’d be out of a job if he caught them trading cryptocurrencies, has since softened his tune. In an interview with HBR in July 2018, Dimon admitted that blockchain is something they’re testing and that they “will use it for a whole lot of things”.

JP Morgan has thus far been more focused on blockchain tech than offering its clients with crypto investment opportunities, despite a report in November 2017 by the WSJ that they were considering whether to provide its clients access to CME’s new bitcoin product through its futures-brokerage unit. In May 2018, the firm created a new position called “Head of Crypto-Assets Strategy” with the aim of seeking out cryptocurrency projects that can be taken to market. It’s recently been rumored that they will be using Bakkt’s infrastructure to service their clients.

Assets Under Management: $1.5 Trillion

Goldman Sachs

In 2015 Goldman Sachs got its feet wet into the world of cryptocurrencies by investing in a Bitcoin brokerage firm called Circle. Towards the end of 2017, rumors began circulating that Goldman Sachs was setting up plans to open its own crypto trading desk. This was confirmed by Bloomberg in December 2017, with plans to launch sometime at end of June 2018. In May of 2018 the NY Times reiterated Goldman’s crypto ambitions, but regulatory approval was quoted as a key hurdle from allowing them to move forward. In July 2018 Lloyd Blankfein’s 12 year long tenure as the Goldman Sachs CEO came to an end, replaced by David Solomon who was reported to be much more keen on Bitcoin and crypto than his predecessor. Solomon mentioned that his firm already offered clients publicly-traded derivatives tied to Bitcoin but said they must “evolve its business and adapt to the environment.”

On September 5 2018, Business Insider surprisingly reported that Goldman was ditching its near-term plans to open a trading desk to focus instead on a crypto custody solution, which was hinted at in August. Goldman CFO Marty Chavez quickly refuted that report as “fake news” the next day in an interview with TechCrunch and said that while their custody solution is not ready so trading ‘physical’ Bitcoin wasn’t not yet possible for them, they were building a trading platform modeled on a commodities futures trading platform. Thus currently Goldman is on track to provide over the counter derivatives, with physical custodial solutions coming further down the line.

Assets Under Management: $474 Billion

Morgan Stanley

Morgan Stanley, just like JP Morgan, has been a bank that’s been proactively testing blockchain technology in some use cases. Along with Bank of New York Mellon, Morgan Stanley have been using blockchain technology based platforms as far back as March 2016 to maintain backup records and process transactions.

Morgan Stanley joined Goldman in January of 2018 when it announced that they too were clearing Bitcoin futures contracts for big institutional clients. CFO Jonathan Pruzan said at the time that Morgan Stanley were not offering custody solutions but were having regular meetings among executives to consider how else to engage with cryptocurrencies. Morgan Stanley CEO James Gorman hasn’t been as dismissive as some other Wall Street CEOs regarding digital currencies and admitted back in September 2017 that they were ‘more than just a fad’.

In July 2018, the firm hired Andrew Peel, a self declared “subject matter expert for bitcoin and cryptocurrency” as “Head of Digital Asset Markets”. In September 2018, Bloomberg got the scoop on Morgan Stanley’s plans for a product that would allow clients to get synthetic exposure to the performance of Bitcoin. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. The technical capability seems to be there and Bitcoin swap trading will supposedly go live following an internal approval process and once there is proven institutional client demand.

Assets Under Management: $6.3 Trillion

BlackRock

As the world’s largest assets manager , BlackRock made huge waves in July 2018 when they announced they were setting up a working group to assess their potential involvement in the crypto space. A BlackRock spokeswoman said the company had been “looking at blockchain technology for several years”, dating back to 2015. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management.

BlackRock CEO Larry Fink hasn’t historically been too fond of cryptos, highlighting back in October 2017 its frequent association with money-laundering. Fink remained skeptical on cryptos in an interview with Bloomberg in July 2018, but expressed that he’s “very excited” about blockchain technology. It was reported in September 2018 that Coinbase has been in talks with BlackRock’s aforementioned working group to seek help in launching a Bitcoin ETF. BlackRock reportedly didn’t give any concrete recommendations, which is inline with the firms mixed stance on the subject after the CEO had said in the previously mentioned interview he didn’t believe “any client sought out crypto exposure”. It remains to be seen how the world’s largest exchange-traded fund (ETF) provider will proceed.

Bakkt

In August of 2018, the crypto world got perhaps its biggest news of the year when ICE (Intercontinental Exchange) announced their 14 months in the making grand ambitions in the digital asset space. In conjunction with Microsoft’s cloud expertise, Starbuck’s extensive know-how in the field of mobile payment, and ICE’s (as one of the largest exchange groups in the world) leadership in the field of financial and commodity markets – a new platform called “Bakkt” was formed.

At the time much of the focus was on the consumer facing section of the platform, and whether the likes of Starbucks would really be accepting cryptos. However it soon became apparent that this was only a fraction of the plans and perhaps most important was the announcement of a fully regulated onramp, which would combine a major CFTC-regulated exchange with CFTC-regulated clearing and custody. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line.

Bakkt, which has been actively recruiting former Coinbase employees, will begin its onboarding and testing phase in November 2018 with trading scheduled to begin in December, subject to CFTC approval. Bakkt CEO Kelly Loeffler hasn’t shied away from expressing the extent of the company’s vision: “We are collaborating to build an open platform that helps unlock the transformative potential of digital assets across global markets and commerce.”

Assets Under Management: $2.6 Trillion

Fidelity

Fidelity has always had a bullish tone when it came to Bitcoin and cryptocurrencies. The world’s 4th largest asset manager dipped its toes into the world of cryptos back in 2015 when it began accepting Bitcoin donations for its charity operation Fidelity Charitable (the second-largest nonprofit fund-raiser in the U.S). The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. In 2017 the firm’s internal crypto fund was forced to suspend operations after two employees involved in the project left to start their own crypto funds. However Fidelity plans to resume operations as it seeks to find a new fund manager.

Fidelity CEO Abigail Johnson (who’s family owns 49% of Fidelity) hasn’t shied away from from evangelizing Bitcoin and admitted to being a big fan of the space in a rare speech at Consensus 2017. Ms. Johnson first became interested in Bitcoin and blockchain tech back in 2014 when the company’s Fidelity Labs began researching disruptive emerging technology and has allegedly personally participated in several of the firm’s crypto initiatives since.

In June 2018, Business Insider reported that Fidelity is planning to make a big move into the world of cryptocurrencies after it got its hand on some job ads. While some clients can already view their crypto holdings next to their other accounts, the plan is to go much further including building its own digital asset exchange as well as custody solutions. During Boston Fintech Week, Ms. Johnson confirmed they had “a few things underway” and that they hoped to have some things to announce by the end of 2018.

In mid-October Fidelity announced a new and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. The new standalone company has around 100 employees and is already in the process of onboarding its first clients with more widespread availability scheduled in early part of 2019.

Assets Under Management: $158 Billion

Citigroup

Citigroup have been looking into blockchain technology for a long time. Back in 2015 Ken Moore, head of Citi Innovation Labs, was quoted as saying that they have been looking at distributed ledger technology for “the last few years”. They were running tests on their very own version of Bitcoin called Citicoin, in the hopes of removing inefficiencies and counter party risk relating to the bank’s cross border prescence. In an interview with Bloomberg in 2017, Citigroup CEO Michael Corbat made it clear that he didn’t think cryptocurrencies were going away and that governments would likely feel threatened and produce their own versions.

In 2017 Nasdaq and Citigroup partnered up and revealed a new blockchain payments initiative that was 3 years in the making. In July 2018, it was announced that Citigroup and 8 other banks would be part of a trial project by CLS and IBM called LedgerConnect, an app store trial for programs based on blockchain technology. In September 2018, Citigroup announced perhaps their biggest plans yet with a product called Digital Asset Receipt (DAR) that is said to enable institutional investors to invest in cryptocurrencies in a fully insured and regulated manner. This direct investment method goes around the tricky regulatory hurdles by emulating American depositary receipts, which has enabled US investors to own foreign stocks for decades.

Assets Under Management: $1.1 Trillion

Bank of America

Bank of America are part of R3‘s consortium of dozens of banks developing frameworks for applying blockchain tech to markets. America’s second largest bank doesn’t exactly see cryptos in the best of lights however. In May 2017, BofA CTO Cathy Bessant expressed her opinion that cryptocurrencies as a payment system are ‘troubling’ since there is no transparency in between the sender and receiver. They admitted in February of 2018 in their annual 10-K filing with the SEC hat cryptocurrency poses a threat to their business.

Despite what they’ve said publicly, BofA have been quietly trying to get its hands onto blockchain technology for years now, filing for over 50 blockchain patents going back to 2014, making it the largest holder of blockchain related patents. Recently in August of 2018, they filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as well.

Other Key Developments

Below is a series of important news that further demonstrate large players entering the space.

In May 2018 Nomura, a leading investment bank headquartered in Japan with nearly half a trillion dollars in assets under management, became the first bank to offer custody services for digital assets by partnering with Ledger and Global Advisors. The new venture called Komainu will provide infrastructure and operational framework to allow institutional level investments that previously was not possible.

After being one of the first online brokerages to offer investors access to Bitcoin futures back in December of 2017, TD Ameritrade announced in October 2018 that it was making a strategic investment in a cryptocurrency spot and futures exchange called ErisX. The platform will provide a crypto on-ramp to retail and institutional investors and signals the company is “all-in” to the world of cryptocurrences.

That wraps up our look at what some of the biggest members of the traditional financial space are up to when it comes to cryptocurrencies. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing to focus on researching the underlying blockchain technology itself. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Whether this is due to overwhelming current client demand or just an expectation of the future remains to be seen – but one thing is clear and that’s the fact that cryptocurrencies have become something Wall Street can no longer ignore.

We’ll be sure to keep this page updated with any developments, so do bookmark it and revisit from time to time.

Trending

-

Articles6 years ago

Articles6 years agoGods Unchained Guide: Investing In The First Blockchain TCG

-

Articles4 years ago

Articles4 years agoBlankos Block Party: The First True AAA Blockchain Game?

-

Articles4 years ago

Articles4 years agoNBA Top Shot: The First Mainstream NFTs?

-

Articles6 years ago

Articles6 years ago13 Rules of ICO Investing

-

Guides6 years ago

Guides6 years agoGuide To Wall Street Interest In Crypto