Guides

Guide To Wall Street Interest In Crypto

Published

6 years agoon

By

TokenFlipper

It wasn’t too long ago that Bitcoin and cryptos were largely frowned upon, seen as a tool only relevant to terrorists and drug dealers. But 2018 has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing around regulatory uncertainty and react to the surge in demand from their clients.

It’s no secret that fresh capital and demand is needed to take the crypto market to new highs, and thus everyone has been wondering where the institutional demand will come from and which large companies will lay the groundwork to allow this on-ramp to happen. Below we present the key actors that are starting to make moves and could serve as catalysts to drive demand upwards.

Assets Under Management: $2.8 Trillion

JPMorgan Chase

JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. The bank’s Blockchain Center of Excellence department developed in conjunction with the Ethereum Enterprise Alliance a project called Quorum, which is currently branded as an “enterprise-focused version of Ethereum”. In March 2018 JP Morgan announced that in light of the platforms popularity and potential, they were considering spinning it off as a separate entity. This is just one of the enterprise platforms that they’re working on and JPM has continuously been at the forefront of financial firms seeking to patent blockchain based securities services.

Even JP Morgan CEO Jamie Dimon who grabbed headlines in September of 2017, when he slammed Bitcoin as a fraud and pretty much threatened anyone in his company they’d be out of a job if he caught them trading cryptocurrencies, has since softened his tune. In an interview with HBR in July 2018, Dimon admitted that blockchain is something they’re testing and that they “will use it for a whole lot of things”.

JP Morgan has thus far been more focused on blockchain tech than offering its clients with crypto investment opportunities, despite a report in November 2017 by the WSJ that they were considering whether to provide its clients access to CME’s new bitcoin product through its futures-brokerage unit. In May 2018, the firm created a new position called “Head of Crypto-Assets Strategy” with the aim of seeking out cryptocurrency projects that can be taken to market. It’s recently been rumored that they will be using Bakkt’s infrastructure to service their clients.

Assets Under Management: $1.5 Trillion

Goldman Sachs

In 2015 Goldman Sachs got its feet wet into the world of cryptocurrencies by investing in a Bitcoin brokerage firm called Circle. Towards the end of 2017, rumors began circulating that Goldman Sachs was setting up plans to open its own crypto trading desk. This was confirmed by Bloomberg in December 2017, with plans to launch sometime at end of June 2018. In May of 2018 the NY Times reiterated Goldman’s crypto ambitions, but regulatory approval was quoted as a key hurdle from allowing them to move forward. In July 2018 Lloyd Blankfein’s 12 year long tenure as the Goldman Sachs CEO came to an end, replaced by David Solomon who was reported to be much more keen on Bitcoin and crypto than his predecessor. Solomon mentioned that his firm already offered clients publicly-traded derivatives tied to Bitcoin but said they must “evolve its business and adapt to the environment.”

On September 5 2018, Business Insider surprisingly reported that Goldman was ditching its near-term plans to open a trading desk to focus instead on a crypto custody solution, which was hinted at in August. Goldman CFO Marty Chavez quickly refuted that report as “fake news” the next day in an interview with TechCrunch and said that while their custody solution is not ready so trading ‘physical’ Bitcoin wasn’t not yet possible for them, they were building a trading platform modeled on a commodities futures trading platform. Thus currently Goldman is on track to provide over the counter derivatives, with physical custodial solutions coming further down the line.

Assets Under Management: $474 Billion

Morgan Stanley

Morgan Stanley, just like JP Morgan, has been a bank that’s been proactively testing blockchain technology in some use cases. Along with Bank of New York Mellon, Morgan Stanley have been using blockchain technology based platforms as far back as March 2016 to maintain backup records and process transactions.

Morgan Stanley joined Goldman in January of 2018 when it announced that they too were clearing Bitcoin futures contracts for big institutional clients. CFO Jonathan Pruzan said at the time that Morgan Stanley were not offering custody solutions but were having regular meetings among executives to consider how else to engage with cryptocurrencies. Morgan Stanley CEO James Gorman hasn’t been as dismissive as some other Wall Street CEOs regarding digital currencies and admitted back in September 2017 that they were ‘more than just a fad’.

In July 2018, the firm hired Andrew Peel, a self declared “subject matter expert for bitcoin and cryptocurrency” as “Head of Digital Asset Markets”. In September 2018, Bloomberg got the scoop on Morgan Stanley’s plans for a product that would allow clients to get synthetic exposure to the performance of Bitcoin. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. The technical capability seems to be there and Bitcoin swap trading will supposedly go live following an internal approval process and once there is proven institutional client demand.

Assets Under Management: $6.3 Trillion

BlackRock

As the world’s largest assets manager , BlackRock made huge waves in July 2018 when they announced they were setting up a working group to assess their potential involvement in the crypto space. A BlackRock spokeswoman said the company had been “looking at blockchain technology for several years”, dating back to 2015. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management.

BlackRock CEO Larry Fink hasn’t historically been too fond of cryptos, highlighting back in October 2017 its frequent association with money-laundering. Fink remained skeptical on cryptos in an interview with Bloomberg in July 2018, but expressed that he’s “very excited” about blockchain technology. It was reported in September 2018 that Coinbase has been in talks with BlackRock’s aforementioned working group to seek help in launching a Bitcoin ETF. BlackRock reportedly didn’t give any concrete recommendations, which is inline with the firms mixed stance on the subject after the CEO had said in the previously mentioned interview he didn’t believe “any client sought out crypto exposure”. It remains to be seen how the world’s largest exchange-traded fund (ETF) provider will proceed.

Bakkt

In August of 2018, the crypto world got perhaps its biggest news of the year when ICE (Intercontinental Exchange) announced their 14 months in the making grand ambitions in the digital asset space. In conjunction with Microsoft’s cloud expertise, Starbuck’s extensive know-how in the field of mobile payment, and ICE’s (as one of the largest exchange groups in the world) leadership in the field of financial and commodity markets – a new platform called “Bakkt” was formed.

At the time much of the focus was on the consumer facing section of the platform, and whether the likes of Starbucks would really be accepting cryptos. However it soon became apparent that this was only a fraction of the plans and perhaps most important was the announcement of a fully regulated onramp, which would combine a major CFTC-regulated exchange with CFTC-regulated clearing and custody. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line.

Bakkt, which has been actively recruiting former Coinbase employees, will begin its onboarding and testing phase in November 2018 with trading scheduled to begin in December, subject to CFTC approval. Bakkt CEO Kelly Loeffler hasn’t shied away from expressing the extent of the company’s vision: “We are collaborating to build an open platform that helps unlock the transformative potential of digital assets across global markets and commerce.”

Assets Under Management: $2.6 Trillion

Fidelity

Fidelity has always had a bullish tone when it came to Bitcoin and cryptocurrencies. The world’s 4th largest asset manager dipped its toes into the world of cryptos back in 2015 when it began accepting Bitcoin donations for its charity operation Fidelity Charitable (the second-largest nonprofit fund-raiser in the U.S). The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. In 2017 the firm’s internal crypto fund was forced to suspend operations after two employees involved in the project left to start their own crypto funds. However Fidelity plans to resume operations as it seeks to find a new fund manager.

Fidelity CEO Abigail Johnson (who’s family owns 49% of Fidelity) hasn’t shied away from from evangelizing Bitcoin and admitted to being a big fan of the space in a rare speech at Consensus 2017. Ms. Johnson first became interested in Bitcoin and blockchain tech back in 2014 when the company’s Fidelity Labs began researching disruptive emerging technology and has allegedly personally participated in several of the firm’s crypto initiatives since.

In June 2018, Business Insider reported that Fidelity is planning to make a big move into the world of cryptocurrencies after it got its hand on some job ads. While some clients can already view their crypto holdings next to their other accounts, the plan is to go much further including building its own digital asset exchange as well as custody solutions. During Boston Fintech Week, Ms. Johnson confirmed they had “a few things underway” and that they hoped to have some things to announce by the end of 2018.

In mid-October Fidelity announced a new and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. The new standalone company has around 100 employees and is already in the process of onboarding its first clients with more widespread availability scheduled in early part of 2019.

Assets Under Management: $158 Billion

Citigroup

Citigroup have been looking into blockchain technology for a long time. Back in 2015 Ken Moore, head of Citi Innovation Labs, was quoted as saying that they have been looking at distributed ledger technology for “the last few years”. They were running tests on their very own version of Bitcoin called Citicoin, in the hopes of removing inefficiencies and counter party risk relating to the bank’s cross border prescence. In an interview with Bloomberg in 2017, Citigroup CEO Michael Corbat made it clear that he didn’t think cryptocurrencies were going away and that governments would likely feel threatened and produce their own versions.

In 2017 Nasdaq and Citigroup partnered up and revealed a new blockchain payments initiative that was 3 years in the making. In July 2018, it was announced that Citigroup and 8 other banks would be part of a trial project by CLS and IBM called LedgerConnect, an app store trial for programs based on blockchain technology. In September 2018, Citigroup announced perhaps their biggest plans yet with a product called Digital Asset Receipt (DAR) that is said to enable institutional investors to invest in cryptocurrencies in a fully insured and regulated manner. This direct investment method goes around the tricky regulatory hurdles by emulating American depositary receipts, which has enabled US investors to own foreign stocks for decades.

Assets Under Management: $1.1 Trillion

Bank of America

Bank of America are part of R3‘s consortium of dozens of banks developing frameworks for applying blockchain tech to markets. America’s second largest bank doesn’t exactly see cryptos in the best of lights however. In May 2017, BofA CTO Cathy Bessant expressed her opinion that cryptocurrencies as a payment system are ‘troubling’ since there is no transparency in between the sender and receiver. They admitted in February of 2018 in their annual 10-K filing with the SEC hat cryptocurrency poses a threat to their business.

Despite what they’ve said publicly, BofA have been quietly trying to get its hands onto blockchain technology for years now, filing for over 50 blockchain patents going back to 2014, making it the largest holder of blockchain related patents. Recently in August of 2018, they filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as well.

Other Key Developments

Below is a series of important news that further demonstrate large players entering the space.

In May 2018 Nomura, a leading investment bank headquartered in Japan with nearly half a trillion dollars in assets under management, became the first bank to offer custody services for digital assets by partnering with Ledger and Global Advisors. The new venture called Komainu will provide infrastructure and operational framework to allow institutional level investments that previously was not possible.

After being one of the first online brokerages to offer investors access to Bitcoin futures back in December of 2017, TD Ameritrade announced in October 2018 that it was making a strategic investment in a cryptocurrency spot and futures exchange called ErisX. The platform will provide a crypto on-ramp to retail and institutional investors and signals the company is “all-in” to the world of cryptocurrences.

That wraps up our look at what some of the biggest members of the traditional financial space are up to when it comes to cryptocurrencies. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing to focus on researching the underlying blockchain technology itself. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Whether this is due to overwhelming current client demand or just an expectation of the future remains to be seen – but one thing is clear and that’s the fact that cryptocurrencies have become something Wall Street can no longer ignore.

We’ll be sure to keep this page updated with any developments, so do bookmark it and revisit from time to time.

You may like

Articles

Blankos Block Party: The First True AAA Blockchain Game?

Published

4 years agoon

October 23, 2020By

TokenFlipper

Since the world’s first encounter with the COVID-19 pandemic, people have naturally been spending an increasing amount of time indoors and by extension spending more time to play video games, leading to significant surges in gaming sales. In these difficult times, our perpetual need for social interaction has not only resulted in the high usage of communication tools like Zoom, but also with simple multiplayer online games with small budgets like Fall Guys and Among Us breaking Twitch viewership records – the latter getting nearly half a million viewers during a broadcast featuring streamer all-stars and the ever popular US Congresswoman Alexandria Ocasio-Cortez. The undeniable success of such interactive party games no doubt makes the present a great time to enter the space and Mythical Games with their title “Blankos Block Party” aims to do just that.

Mythical Games

Mythical Games is a Los-Angeles-based developer that describes itself as “a next generation game technology studio”. Founded in 2018, they have raised $16 million in two rounds of funding in the same year followed by an additional $19 million in November 2019 from a group of Venture firms lead by Javelin Venture Partners and including Galaxy Digital – totaling $35 million in funding. They currently have about 50 employees with an executive team that packs plenty of industry experience having had high-level roles at Activision Blizzard, Electronics Arts, Oculus VR, Zynga, and Telltale Games.

Leveraging their dGoods blockchain technology, Mythical aims to create universal economies driven by player ownership with the core belief of “true ownership of digital assets, verifiable scarcity, and integrated secondary markets are the future of games”. They want to create a platform that provides a suit of services which other developers can use to make their very own player-owned and driven economies around their games. What better way to prove the effectiveness of this model than showing by example, with Blankos Block Party. Here is its first gameplay trailer, released in June:

What is Blankos Block Party?

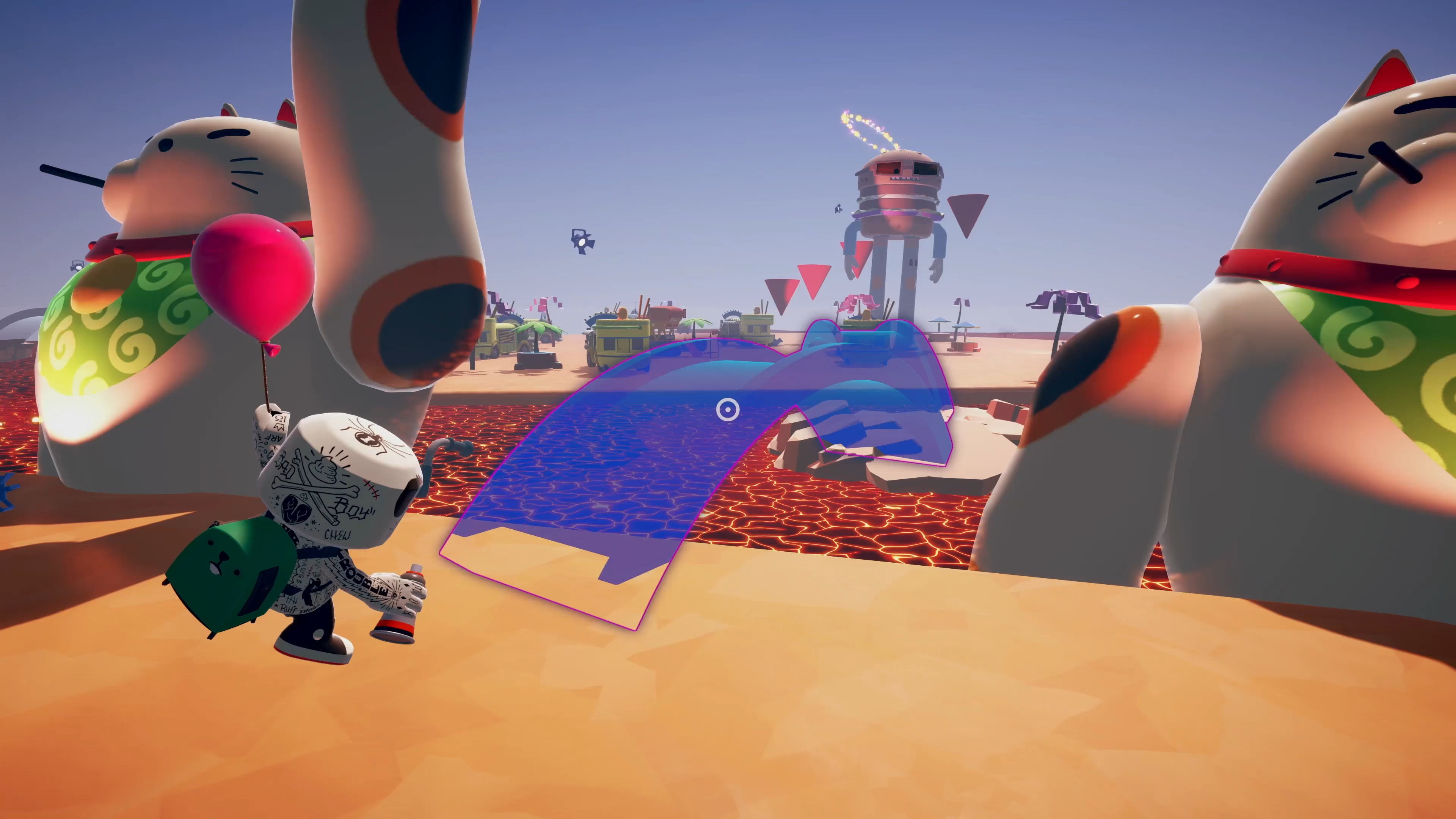

Blankos Block Party is a free-to-play MMO party game set in a vibrant online world styled like a giant block party called ‘The Junction’, with a focus on custom art and design, world-building and exploration, and collecting unique Blankos. Using an ever-expanding array of building items, toys, and accessories, players will be able to design and build various types of single or multiplayer parties that include any combination of shooting, racing, and collection challenges in a user-friendly manner without any coding knowledge. The most popular user-created content will be richly rewarded.

Making your own levels is as easy as clicking a button

At the center of gameplay are of course Blankos, fun and mischievous collectible digital vinyl toy characters each custom designed by talented artists. Players will not only be able to collect and customize their Blankos with different powers and abilities of their choosing as they level up but also make them truly unique with a wide range of skins, accessories, and gear.

The Beta will have dozens of unique Blankos designed by industry-leading artists with more to come

What makes the game stand out as an AAA title and why we cover it: its blockchain elements. Each Blanko as well as other game items are NFTs that will be minted on an EOS private blockchain, where the asset’s security, ownership history, and provable scarcity are established. Players will be able to buy and sell these NFTs for FIAT currencies in the game’s marketplace as well as other trusted blockchain mainnets and marketplaces when those connections are made with time.

Investment Potential

With multiplayer party games’ current popularity and the pandemic not going away anytime soon, this is a good time for Blankos Block Party to enter the market. The game looks polished and fun while the content-creation tools pave the way for unlimited new content. Though EOS isn’t known to be the most decentralized or adopted blockchain, it is more than capable of doing what’s needed from it: providing the NFTs provable ownership. In any case, game development is still very much a centralized proposition so users have no choice but to place their trust in the team – which in this case very much seems like a well-backed competent bunch.

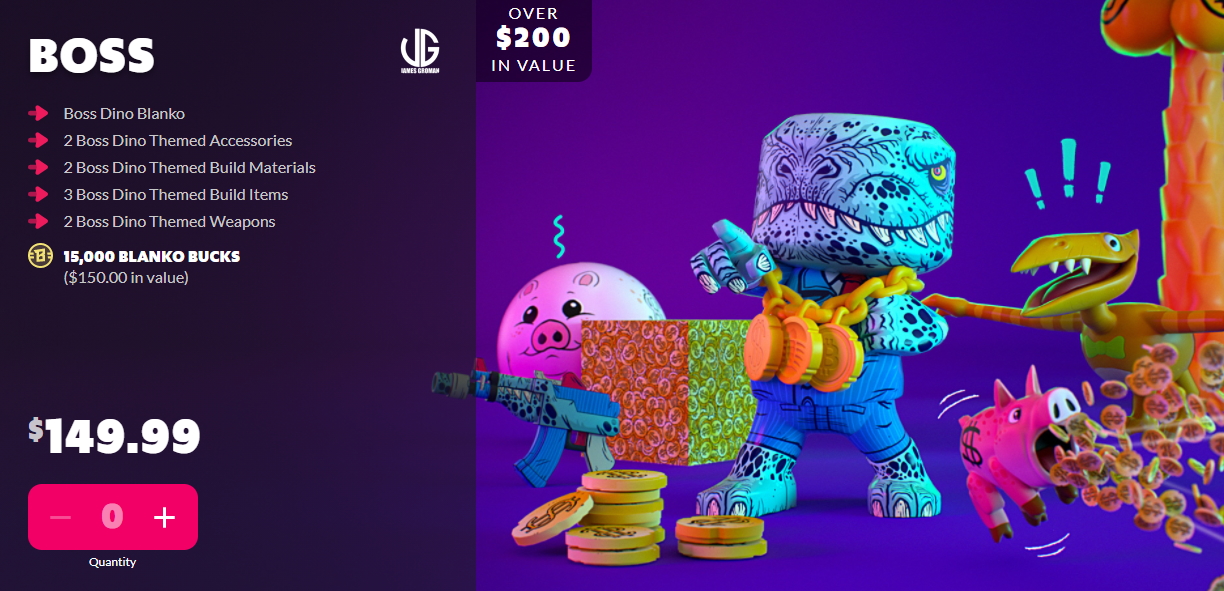

The NFT real-money trading aspect should provide additional incentive to keep people engaged and playing like we’ve never quite seen before in this type of game. The Founders Packs offered are not only limited in supply, potentially making the contents quite scarce and lucrative if the game receives mass adoption like planned, but also offer lots of additional value in the form of Blanko Bucks – the in-game currency with which NFTs can be bought from the game’s own shop.

The 4 types of Founders Pack available in the pre-sale are priced at $150, $100, $50, and $25 respectively.

With that said, the project isn’t beyond reproach. The pre-sale launched with no disclosure of Founder Pack supply limits, without even a time-based cut-off. Not providing this basic level of transparency, which the blockchain could and should easily enable, is confusing to say the least. Furthermore, the marketplace will not launch with the November 17th Closed Beta and is planned for end of 2020/beginning of 2021. This means the NFTs within the Founder’s Packs purchased are trade-locked for at least a few months.

Lastly, the in-game currency Blanco Bucks is not a cryptocurrency and cannot be sold by players in marketplaces – likely due to stringent US regulations – which will inevitably lead to its trade in gray markets (something the devs had specifically mentioned they wanted to avoid with this setup). The game could really stand to gain from a liquid ‘valueless’ ERC20 coin that can be earned and traded to create that important Play To Earn path to draw in the large Free to Play player segment.

How To Invest

At the time of this writing, all Founder Packs are still available on the game’s website. They all offer good value at different price points though bigger investors will likely pull the trigger on the most expensive “Boss Pack” for as much as they are willing to spend.

This may be the first Pack to sell out, if whales have anything to say about it.

If you’d like to learn more about Blankos Block Party, check them out on their official channels: website, Twitter, Discord, Facebook, Instagram, and Youtube.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

Polyient Games: The Ultimate NFT + DeFi Ecosystem?

Published

4 years agoon

October 1, 2020By

TokenFlipper

Probably the hottest trend in crypto since the 2017 ICO boom has been the recent explosion of DeFi and the yield farming / fair launch movement that has come with it. This has opened up a highly profitable and engaging set of composable blocks for agile developers to swiftly put together. While the first wave of that trend seems to be fizzling out, it has no doubt paved the way for more innovation. A particularly interesting topic has now taken over the conversation: the resurgence of NFTs – which had laid dormant since the 2017 CryptoKitties mania. One ambitious project in particular aims to bring the world of NFTs and DeFi together under one umbrella and be the ultimate one-stop shop for everything NFTs, going by the name “Polyient Games”.

Polyient Games

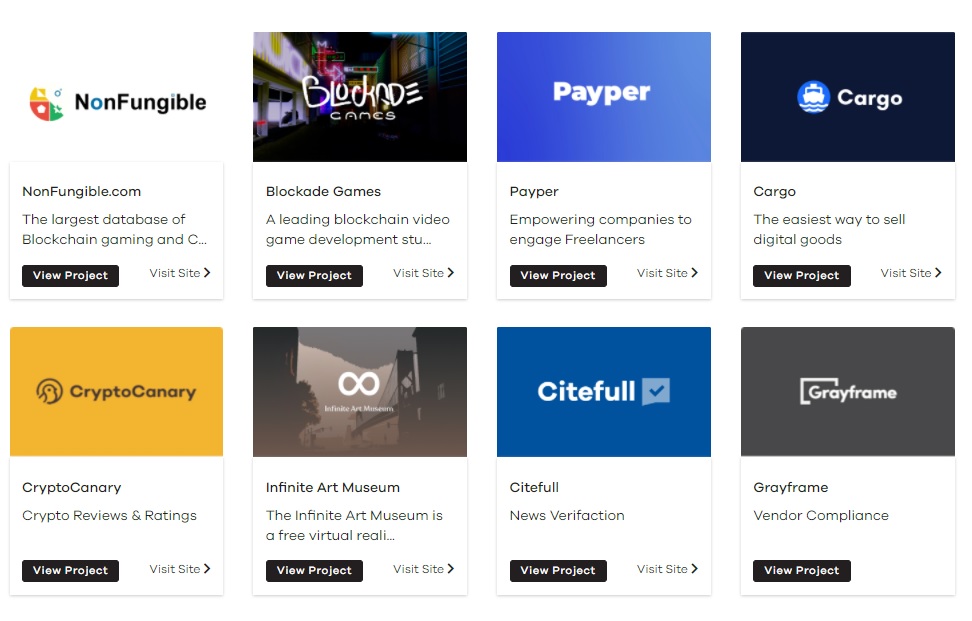

Polyient Games (PG) bills itself as the industry’s first investment firm focused on non-fungible tokens (NFTs) and blockchain gaming. Their parent company Polyient Labs is an early-stage blockchain startup incubator that has made investments into prominent up-and-comers in the space such as NonFungible.com and Cargo.build. With PG, the goal is to make investments into promising and preferably cross-chain blockchain projects that “unlock the full value potential of the non-fungible token (NFT) asset class”. Besides being an incubator and supporting partners with a wide range of services, the team also aims to build their own products and platforms leveraging some of the cutting-edge tech driven by their portfolio companies.

Just a few of the blockchain startups in the Polyient Labs portfolio.

The first of these is a collaborative environment dubbed the Polyient Games Ecosystem (PGE) which aims to bring together a wide array of entities from a range of networks and verticals to collectively take the space to the next level and grow the pie for all involved in what is still a very nascent industry. Luckily for crypto investors wanting to be involved in this exciting environment, Polyient Games recently conducted a sale of tokens that exposes investors to a lot of the cool stuff going on in the ecosystem in the form of the Polyient Games Founders Key (PGFK).

The early PGE partners include some of the biggest blockchain games on the market.

Polyient Games Ecosystem

The Polyient Games Ecosystem is powered by the PGFK token and understanding either requires a closer look at the four key pillars that will constitute the PG Ecosystem.

Polyient Games Vault

At its very root, the PGFK token is an ultra-rare NFT enabling holders to gain lifetime rewards and membership to exclusive sections of the PG Ecosystem. The PG Vault is where you can take your PGFK tokens and stake them to earn from a range of rewards including chance based drops (made possible by Chainlink’s VRF – a provably-fair and verifiable source of randomness on-chain) and yield farming rewards coming from a combination of third-party partner token distributions and Polyient Games-specific rewards.

What’s interesting is that the amount of PGFK you hold and their generations (explained later) will serve to amplify your chances at the random drops and improve your farming power. There’s even been talk by the team of earning participation and achievement ‘badges’ that will go towards further boosting yield rates in a gamification layer that serves to seamlessly merge NFT, DeFi, and gaming.

Cargo gems are only the first of a perpetual set of rewards that PGFK holders will receive by simply staking their tokens inside the Vault.

There will be reward airdrops monthly and the first announced reward for PGFK holders is a share of the main utility token for Cargo – a NFT creation and trading platform similar to Rarible. It’s expected that the more the PG ecosystem grows – whether through direct investment by Polyient Games or through projects wanting to join the PG Ecosystem – the larger the potential reward pool will be for PGFK holders.

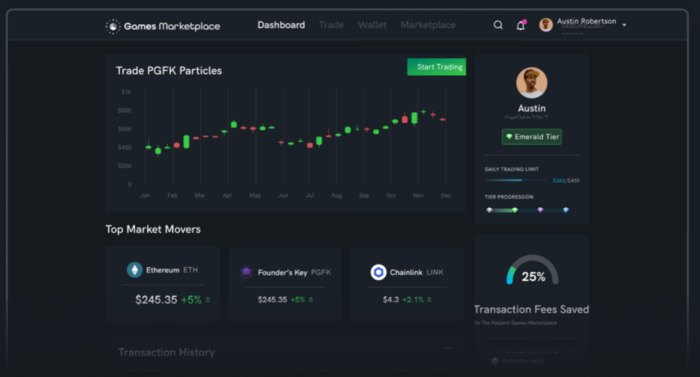

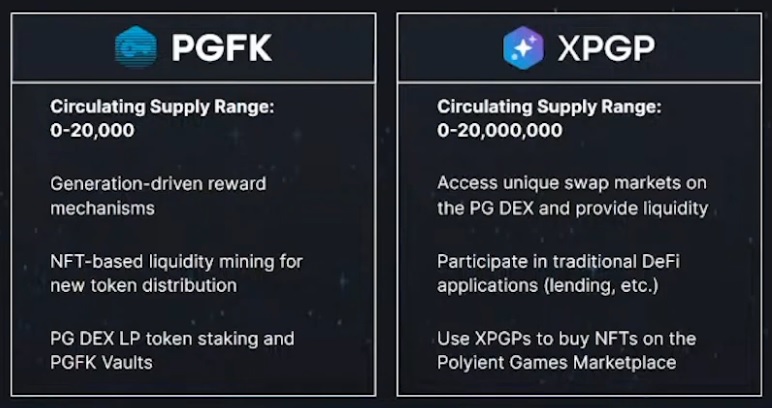

Polyient Games Dex

One of the main products being developed is the Polyient Games DEX. This is a crucial aspect of the ecosystem because it addresses the illiquid state of current NFT projects and those who invest in them. This fungible token exchange will be fueled exclusively by PGFK Particles in a token called XPGP (a utility token that represents a 1:1000 fraction of a PGFK). You will be able to put a PGFK (ERC-721) into the “Particle Bridge”, effectively burning them and receiving in return 1000 XPGP (ERC-20). You can similarly take 1000 XPGP (burn them) and send it through the Bridge to mint 1 PGFK NFT. We noted earlier that PGFK tokens have generations and each time a PGFK is sent through the bridge and deconstructed into XPGPs (or vica versa), the received PGFK or XPGP loses its previous generation number and is minted into a new generation. This thus creates a deflationary aspect for older generations which will favor ‘hodlers’ in PGFK Vault yield farming situations. This organic incentive for early gen0 PGFK holders to keep their NFTs is expected to trickle onto the rest of the ecosystem in terms of removing selling pressure, and ultimately raise prices given demand for either PGFKs or XPGPs grows over time.

It’s coming… 👾 pic.twitter.com/tmRKAU2Lla

— Polyient Games DEX 👾 (@PolyientDEX) September 22, 2020

The Polyient Games DEX will come in two waves – the first version is on the verge of release and will essentially be an adapted Uniswap fork that will quickly get things up and running on the Ethereum network. What’s much more interesting is version 2 that is slated for the end of 2020. V2 is a fast and cheap DEX built on the recently released Avalanche network by Ava Labs on their X-Chain. Combining the widely adopted token standards of Ethereum with the speed and cost of the Avalanche network could be a huge boon for a sector of the market that lives or dies by gas costs, in no small part due to the low-dollar-value of a lot of the transactions that take place. To incentivize liquidity on the XPGP-token pairs, you’ll be able to take your LP token and stake it inside the PGFK vault for further rewards beyond the trading fees generated – similar to what we’ve seen recently become popularized by the likes of Yams and Sushi yield farm projects.

Polyient Games Marketplace

The Marketplace is the wider umbrella under which the PG DEX sits, but it’s important to note it as a separate entity because of what it can potential bring the NFT space. Currently, one of the main problems plaguing the NFT space is a lack of liquidity (especially for the non-fungible tokens that can’t be traded on your usual exchanges) and no central flexible marketplace on which to explore the vast happenings in the space.

An NFT-focused marketplace that solves UX deal-breakers centered around speed and cost currently plaguing the Ethereum network is desperately needed.

The PG marketplace has the potential to be the Steam of NFTs as beside from benefiting from the DEX and the Vault mentioned above, it will be a curated place where traders, investors, liquidity providers will all be interacting with each other. With all the money and eyeballs already locked into the ecosystem, it can serve as a concentrated and integrated platform where new NFTs can be showcased, presales conducted, and auctions can be had. This will naturally depend on how well Polyient Games is able to bring the different players in the wider NFT world together but the incentives are certainly there.

Polyient Games DAO

PGT is the native governance token for the Polyient Games Ecosystem and has been given to all participants in the initial PGFK sale on a 1:1 ratio. While the DAO is not expected to be operational this calendar year, the founding team have made their intentions clear that they plan to migrate the majority of decision making authority to PGT holders over time. Some of the areas under review for decision making migration include:

● PGFK Reward Vault Yields

● PGFK to XPGP conversion ratios

● PG partner participation criteria

● PG DEX rewards for liquidity providers

● Distribution of rewards generated by PG DEX transaction fees

As we’ve seen with many successful projects, the initial build-out by a centralized team to then transition to have the decision making be passed on to the community is a great way to live by the crypto ethos of decentralization as well as better fight any potential future regulations that could more easily target centralized entities.

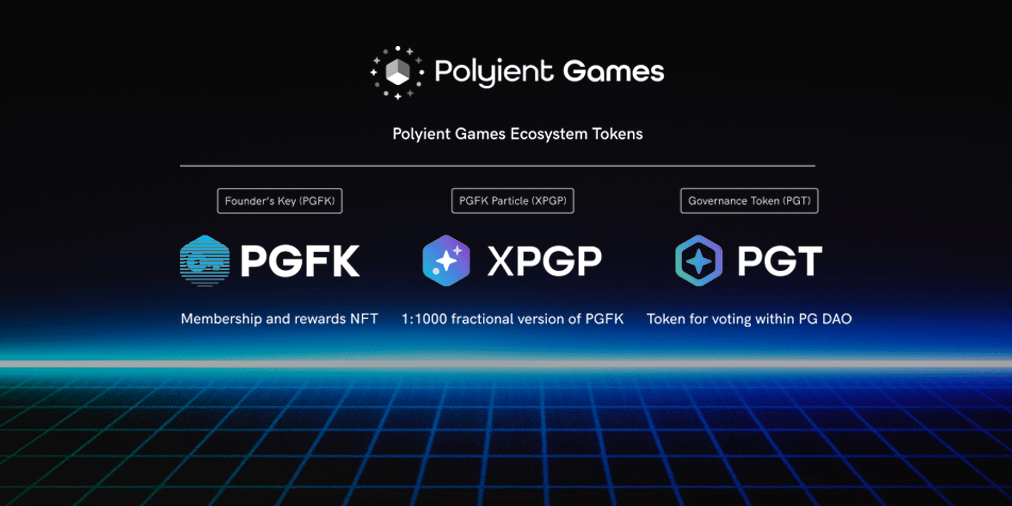

The three tokens in the ecosystem revolve around reward drops (PGFK), marketplace currency (XPGP), and governance (PGT).

Polyient Games Founders Key (PGFK) Token

The majority of PGFK tokens (12,000 out of total 20,000) were sold during a week-long sale that started on September 15 and sold out just few hours before the September 22 end date. They were sold at a price fixed to 1 PGFK equaling 400 DAI and the only cheaper tokens available were sold at a 20% discount in a presale for 500 PGFK conducted in mid-July. The rest of the 7,500 tokens were divided as follows:

— Partners & Giveaways: 7.26%

— XPGP Liquidity: 66.67%

— Team: 26.07%

As you can probably appreciate when we discussed the PG Ecosystem, the PGFK token is one of the most unique tokens to have hit the crypto scene in quite a while. The dual state in which a non-fungible ERC-721 can fluidly alternate between being a utility token fueling the marketplace side to a rare NFT with MMORPG-like traits that generates a lifetime worth of NFT lootbox-like rewards on the other is quite a fascinating dynamic. Let’s look again at the benefits that have been announced by the team to consider the active token tradeoffs for holders in the ecosystem.

PGFK

● PGFK Holders-only Lobby: PGFK Holders can directly communicate with the Polyient Games team, Ecosystem partners, Games, and other PGFK community members.

● PGFK Member Rank: Given the scarce supply of PGFKs, PG will be leveraging a number of random-chance events to reward holders, including loot box and NFT airdrops.

● Early-Access to the Polyient Games Marketplace

● Polyient Games Marketplace Fee Reductions: All transactions within the Polyient Games Marketplace will include fees that will be collected by Polyient Games to reinvest in the Ecosystem.

○ Early Polyient Games adopters will have the opportunity to reduce and even remove these fees by stacking PGFKs. With the roll-out of the full PG Marketplace, PG will reduce 1% of the transaction fees with each PGFK held in a user’s wallet.

○ Fee reductions will initially be associated with NFT purchases, but it will likely be extended to the PG DEX. This fee will only be factored into Polyient Games’ fees and not transactional fees destined for liquidity pool participants.

● Early-Access to the Polyient Games Particle Bridge: The more PGFKs you hold, the sooner you will have access to the smart contracts necessary to convert them into XPGPs.

● Early-Access to Polyient Games Usernames: The more PGFKs you hold, the sooner you will be able to claim your official Polyient Games Web 3.0 username.

XPGP

● Main transactional unit for all purchases made within the PGE platform.

● Main payment option for NFT pre-sales and auctions conducted within the PGM.

● Main trading pair for all fungible tokens listed on the PG DEX, including Ecosystem member in-game currencies, Polyient-backed token projects, and more.

PGFK Investment Potential

The NFT and DeFi space is moving fast and PGFK seems to be in prime position to capitalize on that trend by taking the focused investment approach of the Polyient Games team and using that to build out a wider ecosystem that will invite both the big developers / creators in the space as well as the technological partners such as Ava Labs and Chainlink to give the whole sector a chance to flourish at scale. While as a PGFK holder you don’t get any equity or direct stake in the companies within the PG portfolio or the wider PG ecosystem, there’s so far been conceited efforts demonstrated by the PG team to see PGFK holders rewarded, whether that’s through direct distribution of the main utility token in the case of Cargo or through the recent investment in Community Games which utilizes their decentralized tournament hosting capabilities to run exclusive tournaments with prizes for PGFK holders.

A look at what’s to come in the near future.

At a $8m fully diluted marketcap during the sale, the project was very competitively-priced when compared to the valuations of platforms such as $MEME which have a much smaller scope on the surface. Of course at the end of the day, it will come down to the execution of the different parts mentioned above and how well they use their position and network to stay ahead of the field by being the one-stop shop for NFTs in combination with the exciting doors that DeFi opens up. It cannot be understated that blockchain games/projects are greatly incentivized to join the PG ecosystem, not only due to instant exposure to a highly targeted and invested userbase but also near-instant liquidity provided by the PG DEX, allowing them to spend their valuable development resources on what they do best: make great products.

Seeing as DeFi and NFTs are the two hottest sectors in crypto right now and will remain so for the foreseeable future, this seems like an exciting ecosystem to be a part of both for developers and investors alike. Whether Polyient Games ends up being the ultimate NFT + DeFi ecosystem as the title questions remains to be seen, but they currently seem to be ahead of the pack in terms of bringing all these concepts together and having a cohesive scalable plan to make it a reality. Even though games and art are the logical kickstarters of today’s NFT ecosystems, anything from the real world can and will eventually be made into NFTs, and a flexible (incentives + marketplace + DEX), cheap (AVAX), and community-driven (DAO) ecosystem has as good of a chance to capture a piece of the much bigger pie of the future as any proposed solutions we have seen to date.

The scope of areas that Polyient Games aims to cover in the future is wide and vast..

How To Invest

Since the sale is over, the only place to get a hold of PGFK tokens is on NFT marketplaces such as OpenSea. The price as of this writing is slightly above the initial sale price but good deals may be found for those willing to wait for sellers in need of fast liquidity.

If you’d like to learn more about Polyient Games, check them out on their official channels: website, Twitter, Discord, and Telegram.

The author as of this writing holds tokens relating to this project. None of this is financial advice and you should conduct your own research before making any decisions relating to the topics discussed in this article.

Articles

Gods Unchained Guide: Investing In The First Blockchain TCG

Published

6 years agoon

August 19, 2018By

TokenFlipper

Birth of NFTs

Collectibles has been a hot topic in the crypto world ever since CryptoKitties exploded onto the scene in December 2017. Combining the power of the Non-Fungible Token (NFT) technology, the mainstream adoption of creature catching/breeding games thanks to Pokemon Go, and the soft-spot we all have for just about anything with kitties, CryptoKitties became an overnight success. Its disruption was so significant that it not only congested the Ethereum network, using 20% of its computing power at one point, it also had some of its kitty tokens sell for over $100,000. Seeing the immense potential ERC-721 NFTs, many blockchain developers entered the space with their own Dapps – one of those being Gods Unchained developer Fuel Games.

Meet Founder Cat #18, the most expensive cryptokitty ever sold.

Fuel Games

Fuel Games’s first foray into the field happened in March with a game called Etherbots. Etherbots allowed users to create their own bots with parts of varying rarities (ERC-721 tokens) randomly dropped from purchasable crates, and ultimately battle others’ bots – all on the Ethereum network. At its much-anticipated launch, more than $1 million worth of parts were sold, accounting for 5% of all Ethereum transactions, while some parts were selling for as high as $18,000. With the success of Etherbots, Fuel Games were able to secure $2.4 million in funding in July from various Capital ventures, including Coinbase, for their next title: Gods Unchained.

Etherbots Marketplace where players sell their tokens for Eth

What is Gods Unchained?

Have Gods and Mythical creatures do my own bidding? Sign me up!

Gods Unchained is a Tradable Card Game (TCG) with a unique IP that borrows some gameplay mechanics from industry leaders like Hearthstone and Magic the Gathering while also mixing in some of Fuel Games’ own innovations. Players choose one of six God, each with their own unique God Powers, and build 30 card decks to do battle (see the Gameplay Trailer – revealed on November 15th – below).

The first innovation Gods Unchained brings to the table is the ability for each player to choose and lock one of 5 God Powers at the very beginning of each game. This allows for players to somewhat adapt their deck’s strategies on the fly according to their expected match-up. Here are the Gods along with their revealed Powers:

The God of Light Thaeriel can use only one of the above 5 God Powers each game. The first 4 can be used repetitively while Equinox (the Ultimate) can only be used once per game (if chosen as the God power).

The God of War Auros’s 5 God Powers.

The Goddess of Nature Aeona’s 5 God Powers.

The God of Magic Elyrian’s 5 God Powers.

The Goddess of Death Malissus’s 5 God Powers.

The Goddess of Deception Ludia’s 5 God Powers.

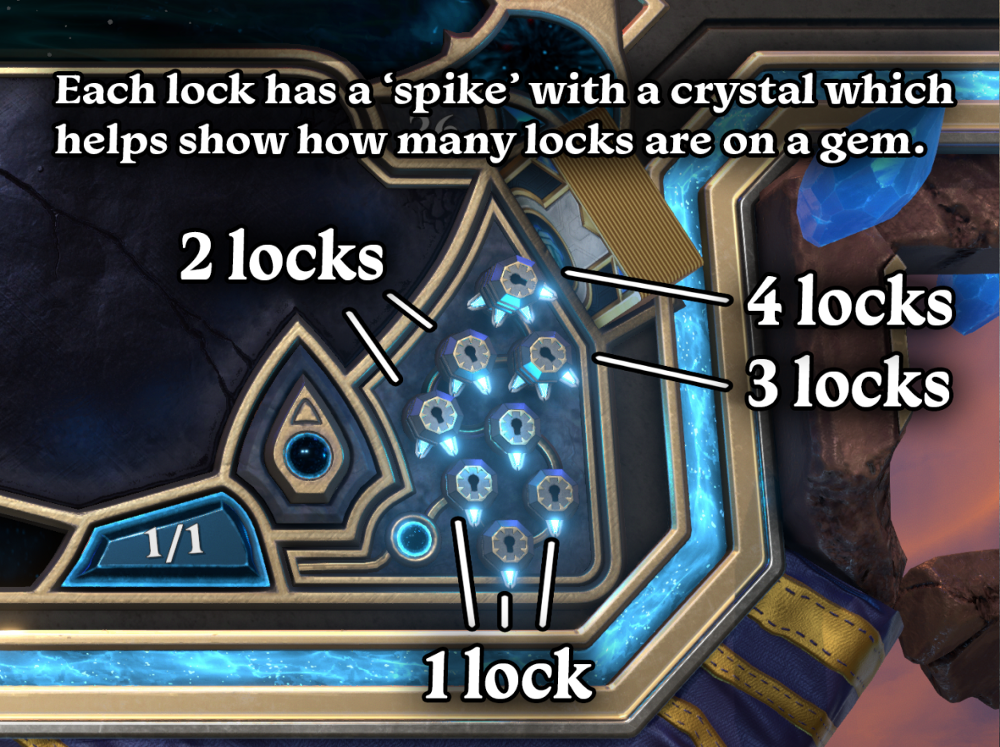

The other innovation that sets Gods Unchained apart from the other card games is the game’s very own Mana Lock resource system. In Gods Unchained, you will unlock one mana lock at the start of each of your turn and refresh all empty mana gems. There is one lock on each of your first five mana gems, so you’ll be unlocking one gem turns 1–5, just like any other traditional automated system. The sixth mana gem, however, starts the game with two locks on it, and won’t be accessible until turn 7. There will be two locks on your seventh mana gem (accessible turn 9), three locks on your eighth mana gem (accessible turn 12), and four locks on your ninth mana gem (accessible turn 16). Designers hope this unique system will create snappier games with more interactions between players while they have the leeway to print much more powerful cards at higher mana costs.

The other aspects of the game are made up of the tried and true characteristics of successful TCGs of the past. Cards are obtained via opening randomized packs. Packs contain 5 cards, which are all unique ERC-721 tokens, that come in 4 different Rarities (Common, Rare, Epic, Legendary) as well as 4 different Shine – or cosmetic – levels (Standard, Shadow, Gold, Diamond). Each card even has its own Purity value within each Shine category and the highest ones actually have shinier in-game graphics. The probability of each Rarity, Shine level, and Purity value is hard-coded into smart contracts while the scarcity of each and every card is visible for all to see thanks to the transparency of the blockchain. You can check the Purity values of your cards by inputting your Eth address here.

Each card opened in packs has a % to spawn with a cosmetic upgrade. The scarcity of the higher tiers will make them truly sought-after collectibles.

True ownership of their cards is something TCG players had never achieved going from the paper card days to the modern era of digital card games – until Gods Unchained. In fact, the hype for this unreleased game is so high that $2 million worth of Genesis Set packs have already been pre-sold on their website. A Mythical card (one-of-a-kind, with only 4 unique ones released per year) was auctioned off for over $60,000, making it the second most valuable card in the world behind Magic the Gathering’s Black Lotus.

The Mythical Titan Hyperion. Mythics will not be legal in Tournament play.

Why Invest?

The game is expected to release its Beta in Q4 of this year and purchasing any amount of packs will grant you access to the Beta. The Limited Edition Genesis Set, made up of 380 unique cards, will be sold until either the hard-cap of $15 million is reached or the game launches in Q1 2019 and will never be available again. There is also still 1 ultra-rare Mythic card that have yet to pulled from the Genesis Set packs. There will be a separate non-tradable Core Set of 250 cards that is fully unlocked with Free-to-Play, with which one can make decks good enough to compete. However, having access to the Genesis Set cards will give an edge through the flexibility of being able to craft the most powerful meta decks of one’s choosing. The rarer Genesis Set cards are therefore expected to fetch hefty prices in the secondary markets.

Another good reason for backing this project is that Fuel Games have established a good track record with the success of Etherbots and are known to reward their early adopters handsomely with goodies in their future titles (see Etherbots promotion below), already mentioning having plans for Genesis card owners. Last but not least, the importance of the design team having the influential mind and streamer “ADWCTA” from a game whose playerbase is being targeted (Hearthstone) cannot be understated.

What Packs to Buy?

There are currently 4 types of packs on offer at different price points: Rare Pack, Epic Pack, Legendary Pack, and Shiny Legendary Pack. Which pack has the best value? How much of each pack should you buy? We’ve done the math and here are the results:

If your goal is to complete a Set of all 380 cards:

Rare Packs + Legendary Packs

Rare Packs are the best source of Rares + Epics and should be prioritized over the Legendary packs (Epic Packs are terrible value and should not be touched). Once you reach the desired amount of Epics – as you will collect all Commons & Rares way before Epics – you can switch to cracking Legendary packs only.

If your goal is to complete a Set of all 380 cards in Shadow, Gold, or Diamond Shine level:

Rare Packs + Legendary Packs

It’s not really feasible to collect a Shiny Set of any level from solely opening packs as their drop rates are very low (5% for Shadow, 1% for Gold, 0.2% for Diamond). For Commons, Rares, and Epic Shinies, Rare packs are still the best source because you’re giving yourself the maximum chance to proc the Shinies for the least amount spent. For Legendaries, regular Legendary packs offer better value than Shiny Legendary packs. Shiny Legendary packs at first seem great due to having 25% Gold and 74.8% Shadow chance (Diamond is still 0.2%), increasing your Gold chance by 25 times and Shadow Chance by 15 times while only being 9 times more expensive than regular Legendary packs. However, when we factor in plain Legendaries and our ability to forge them into higher Shine (5 Regular –> 1 Shadow, 5 Shadow –> 1 Gold, 5 Gold –> 1 Diamond), the regular Legendary packs end up giving the better deal.

Forging along with Trading will be the best way to complete your Shiny collection once the game launches.

If your goal is to pull the undiscovered Mythical card from packs:

Rare Packs

The chance for any card in any pack to be Mythic is one in a million – literally. “So you’re saying there’s a chance?!” Yes! And Rare packs are once again your best bet.

If your goal is to achieve maximum value now so you can trade your cards for whatever you want later:

Rare Packs

Every Rare Pack gives you 1/40 of a Legendary, 1/5.7 of an Epic, and 1.1 Rares, not to mention the greatest chance at Shinies and Mythic per amount spent. If we assume some of the most played and sought-after cards will be Rares and Epics (as Legendaries will be limited to one per deck, compared to 2 for every other Rarity), you will be able to trade your duplicates for great value in the secondary markets.

Note: If you’re unfamiliar with Metamask or don’t know how to get some Eth, you can find full instructions on how to buy a pack here.

The first gameplay screenshot was revealed on September 27th.

Championship Tickets

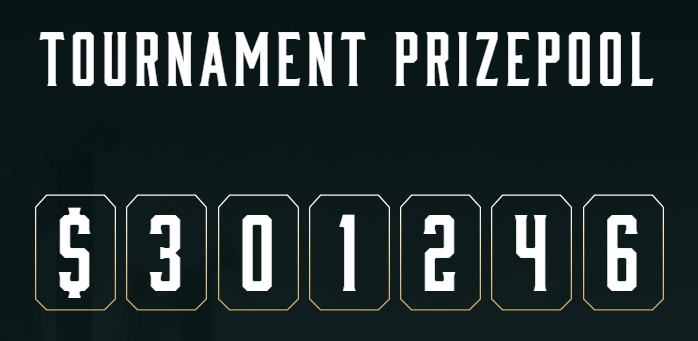

As Gods Unchained labels itself an E-sports game, the competitive scene will be heavily supported. Sometime in Q1 2019, the first Gods Unchained World Championship will take place. The prize pool is set to be $100,000 + 10% of all card pack sales, capping at $1.6 Million if the project hard-cap is reached. Entry into the tournament will require a Championship Ticket, which are ERC 20 tokens that were inserted into the first 20,000 Legendary Packs sold. They have long since sold-out but can be purchased second-hand in exchanges such as Emoon, Idax, Radar Relay, and GUdecks.

Prizepool at the time of writing this article

Other Ongoing Promotions

Gleam Giveaway (now concluded)

Until the end of October, the Gods Unchained Gleam giveaway gave you a shot at winning $10,000 in prizes. You could increase your entries by spreading the word through different channels, with 5 Entries guaranteeing a Gold Legendary (Blessed Chimera) prize. Prize winners were chosen and pack prizes were sent. Chimeras will be distributed right around the time Beta is released.

Etherbots

Each Etherbot part that has existed before July 17th can be used to receive 1 random card in the Etherbots Promotional Set – a special Set made up of 16 unique cards. Shadow or Gold parts used will earn you Shadow or Gold cards. Parts will be turned in sets of 5 to redeem a pack of 5 cards, and if one of those parts happens to be a Lambo or an Ancient Protector, you will receive an exclusive Etherbots Promotional Legendary card.

Etherbot parts can be purchased second hand in Fuel Games’ official Etherbot Marketplace (look for parts with the “GU Eligible” label). The promotion contract will launch in November, and will be available for at least two weeks.

Marketplaces

OpenSea and Rare Bits are 2 marketplaces where users will be able to trade Gods Unchained cards. Special Promotional cards Open Sea Raider and Rare Blitzer will be made available through these 2 marketplaces, respectively. Details on how to obtain these non-tradable cards have not yet been disclosed.

Community Tools

GodsUnchained.info

Global stats of all cards in existence & global collection ranking & detailed collection browser with stats, including packs bought, referrals used, and estimated collection value.

GU.cards

Visual card browser, including all cosmetic versions & deck editor, importer, browser with draw-test tool & multiple-pack-opener tool.

GUDecks.com

Deck editor, browser & card, collection browser.

GUcardprices.com

Rough card pricing estimates based on rarity probabilities and scarcity (Note: we do not endorse their “buyer’s guide”).

The home screen of the first GU Beta client

Further Official Info (from Discord)

Status & Beta

– Beta will roll out in several stages. The Closed Beta has been released to about 130 active community members on November 28th. The next big wave of invites will go out around the time of the next Beta build (0.8) on December 10 to other users who have purchased packs (and registered on apollo.gg). Smaller waves are also going out between patches as the engineering team sees fit. An Open Beta period of around three months will come next, followed by full launch.

– Gods, Genesis Set Cards and Core Set cards will all be released gradually over the course of the beta to give each God and card more analytic attention. You’ll always be able to play the game once you’re in Closed Beta, but there will be time windows where PvP is enabled for stress testing which will gradually expand as beta goes on.

– In Beta, you will have access to the Genesis Set cards you have purchased, and all the Core Set cards (the Core Set cards will be earned through gameplay once the game launches).

– The 1st build of the Closed Beta includes 131/377 Genesis Set cards, 50/250 Core Set cards, 4/6 Gods, and 8/30 God Powers. The 2nd build will have around 400 cards total (around Dec. 10).

– The Beta’s computer spec requirements are quite high for now and does not run well on Mac. Optimization is important to the Devs but it is at least one major update away – they’re focusing on getting all the core functionality into the game first, so the can optimize at the right time.

– Streaming the game and sharing videos is permitted. Devs would just ask at the beginning of any stream or video to share how this is a closed testing beta, with limit cards and features in play, where the point is to gather initial feedback and find bugs.

– Sound effects for individual cards is on the roadmap but may be a couple of releases (builds) away. Voicing is being worked on and casting for it is most likely already finished.

– Shiny cards will get a new animation in a future build (targeted within December) + more cool stuff after that.

– In its current form with most cards not being in the game, Beta gameplay is naturally not balanced (the two most aggressive Gods are not out yet, and the board clears are barely there. So, midranged tokens is going to be dominant). Devs have an internal target for when balancing will kick in and that’s when they will actually start reviewing things from that perspective in terms of beta analytics and feedback.

– The current Mulligan system is not the one Devs designed and the first/second mechanic is just a placeholder that is not designed to be balanced.

– Beta roll-out priority can be summarized as: 1.Fun & competitive gameplay, 2.Missing cards, 3.QoL features (such as chat/friendlist), 4.Missing game modes (such as Battle Royale).

Genesis Set

– The Genesis Set is aimed to be evergreen (will not rotate out of Standard play). Also the Genesis cards will never be re-printed (there may be functional re-prints depending on the meta, but the exact same card will never be released again).

– Prometheus and Atlas are the 2 Mythics in Genesis packs. Prometheus was opened on November 23 but Atlas is still waiting to be found. If it never gets opened, Devs have not confirmed whether it will ever exist. A pack-based lottery is the first system they discussed as it seems the best way to do it, but nothing is finalized.

– The 4th Mythic will not be in packs, will also not be auctioned off.

Game Design

– The God Powers are a little higher impact than Hearthstone hero powers and have varying mana costs (1 to 6). They are designed to be evergreen and the goal is for them not to change or rotate out in any fashion after game launch. God Ultimates are designed to not really be played around (or else they wouldn’t be powerful enough).

– Devs want to create classes (Gods) that play drastically differently in their goals, but are forced to interact with each other repeatedly. Comparatively, MTG’s deck construction aspect is amazing, but its interactions are clunky. And Hearthstone’s decks feel on rails or gimmicky, but interactions are good. GU aims for Lego-like design, but to still retain the Hearthstone levels of interaction (and make those interactions more meaningful).

– Devs have a set power level for all cards, and they won’t be printing cards that are intentionally above the power level of cards that see play.

– There are no “Color-mechanics” in the game because the new player experience wasn’t great with it. For deck-building, GU cards are a lot more modular than Hearthstone. Devs wanted the cards to feel like Lego blocks, as opposed to in Hearthstone where they feel more like puzzle pieces.

– Generally, Deception is the RPS (Rock Paper Scissors) heavy God, Nature is the RNG heavy God, War is the math heavy God, Magic is deep strategy heavy God, and Death/Light are more middle ground.

– Devs’ approach to RNG in GU is to avoid absolute randomness (which is rampant in Hearthstone) and limit it to strategic randomness and/or give players ways to reduce or remove randomness. Controlling RNG of resource generation is one of the top levels of skill to master in a card game, and Nature is the class that will explore it the most. Variance will always be high, but overall, GU’s variance will be significantly lower than Hearthstone, but still present. It will be nowhere near chess.

– Balancing is taken very seriously as GU aims to be an esports game. A lot of math in the form of formulas and processes is used to balance the mechanics and stats of cards. Devs also have a pro Hearthstone player to help with light deckbuilding for basic archetypes of each God to make sure they’re relatively balanced.

– In terms of depth, GU will be more strategic than Hearthstone which is designed for a wider audience. GU cards will have a lot more text space than Hearthstone, but still nowhere near what MTG allows for.

– When comparing GU card power to Hearthstone cards in terms mana cost, the design wants 1 and 2 mana cards to be more powerful than Hearthstone, 3 and 6 mana cost cards to be on the same level, and 4 and 5 mana cost cards to be less powerful than the Hearthstone cards. GU’s removals are also more costly than Hearthstone (Arcane Explosion is where removal options are balanced around, not Twilight Flamecaller).

– All the cards that aren’t blatantly super RNG/meme-y have been designed with archetypes (not specific decks) in mind, that works with God Powers and Core Cards. The goal is any time you think “my deck needs a bit more X”, that you can do that without destroying your whole deck. Subgoal is for the vast majority of cards to be usable by at least 2 God Powers

– There will not be another re-balancing at anywhere near the scale that happened right before Beta. But individual cards will be adjusted through beta, so catching them early means the correct version will get more testing time which would be super helpful. Devs appreciate feedback if anything looks out of balance.

Game Mechanics

– Starting deck size is 30 and the starting hand size is 3 cards. Max creatures on the board is 6 and max cards in hand is 9.

– Runes (a set of small spells), Anims (small creatures), and Enchanted Weapons are are all properly valued (same as if they were independent cards) 2 Mana cards.

– The mechanic “Delve” lets you choose a card at random (not from your deck). All Delve effects from your deck will specifically say so.

– The mechanic “Foresee X” lets you look at the top X cards of your deck and choose whether to keep any of those cards on top or send any of them to the bottom of the deck.

– The mechanic “Ward” blocks one effect that originates from a Spell or a God power (including friendly ones). It does not block Weapons, creature Abilities or Roars.

– The mechanic “Backline” means the creature cannot attack. The creature also cannot be attacked until all friendly non-backline creatures are dead.

– The mechanic “GodBlitz” means the creature or weapon can attack any target the turn it is played (Weapons without this keyword cannot attack right way, just like creatures cannot).

– The mechanic “Flank” allows you to attack any target (including Backline) as long as one other attack has been made this turn.

– Any mechanic appearing more than once in a class (God) is probably a core class concept that will occur in its pure form in the Core Set.

– Gods cannot go above 30 health with the Heal mechanic.

– The order of things when a creature dies is as follows: creature dies, afterlife effects trigger, then it goes to the Void (or is removed from the game if Soulless). Buff effects do not remain when a creature is moved to the Void, unless specified.

– Discards do not go into the Void unless specified. The Void is for cards that have been played from your hand or from the board.

– For any card that has “obliterate cards in the void”, if you have less cards in the void than the amount specified on the card you will not be able to cast the spell. Obliterating specified number of cards in the void is part of the casting condition.

– The God “replace” Legendary cards all have God powers that are stronger than your starting God powers. If you have picked and already used an Ultimate God Power, you cannot get the stronger God power as you have no existing God power to “replace”.

Game Economics

– One does not need to Activate their cards (turning them into ERC 721 tokens) in order to play the game. This is just for selling/trading/transferring your cards once trading is enabled with game launch. Developers have also hinted at implementing a way to only activate the cards/packs of your choice and recommend waiting on activation till Gas prices are low.

– There are plans to support the bundling of cards/sets/decks so they can be transferred in large amounts with one transaction.

– There are no plans for an in-game currency. Although there will be a progression tier where you unlock untradable cards, earning tradable cards/packs through gameplay will not be easy. They will be reserved for winning tournaments / Battle Royales.

– Forging (turning 5 identical cards into 1 of higher Shine) is essentially a burn and mint process, as you’re exchanging old tokens for new ones.

– The upcoming version of the Activation tool will allow for activation of individual cards and will make it possible to forge cards before activating them (you also will be able to forge without doing the activation step at all).

– Unopened packs will not be sold due to legal purposes. Although Devs don’t think they would be classified as securities, they lack the utility to make the team comfortable enough to sell them in such a grey space.

– The official GU marketplace that is being developed with 0x tech is targeted for release sometime between Beta and game launch. It will at first be web-based (as opposed to having an in-game interface) and will allow GU cards as well as Etherbots parts to be traded.

– The goal is to have 4 Seasons per year (new Set every 3 months) with Rare packs for each Season priced around $5 and pegged to USD.

Game UI

– There will be many customization options including Card Backs and custom board items (things which show up on your side of the board which the opponent can also see).

– A deck builder with a share button + an easy way to import decks into the game is in the works.

– In the game when you mouse over cards, you will get an explanation of the relevant keywords to reduce confusion.

– The Tribe info will be on the cards in the game.

Game Modes

– There will be an Elo/Ladder-based Standard competitive (Constructed) mode besides the Battle Royales (Limited mode). Battle Royale may feel a little like “a PvP Slay the Spire”.

– There’s no set date for the World Championship but the target is March – April 2019. In terms of what cards will be legal for it, Season 1 cards most likely will also be in play besides the Genesis Set and The Core Set.

– After about 2 years, Devs will likely create 2 play modes: Standard and Extended. All the cards printed in the last 2 years will be legal in Standard (along with the evergreen Genesis Set) and all the cards in existence will be legal in extended.

– “Single player vs the AI” mode is in the game. However, some type of PvE Story mode will not be in at launch, though the Devs plan to have it eventually.

– There could be content/modes allowing for “dual-god” gameplay in the future (like Hearthstone’s dual-class events). But the early days testing will first make sure the vanilla constructed experience is well-balanced.

Regulation

– Card bans, if necessary, will be done in a decentralized and community-driven manner.

– One is allowed to have more than 1 account. Devs feel they can’t do much to stop that & won’t bother – they’ll leave it trustless.

– Each Eth address can use only 1 World Championship ticket.

– Devs are forbidden from selling their cards on the marketplace.

Wallets

– It is possible to buy packs on mobile using Coinbase Wallet (old name: Toshi), though desktop MetaMask extension is recommended. You cannot transfer the cards from Coinbase Wallet to MetaMask Wallet until the game’s launch, but you can export your private keys from Coinbase Wallet and import into MetaMask to have access to them on your desktop.

– imToken wallet has rolled out support for NFTs and is officially endorsed by GU.

– You will be able to change your email address associated with your card wallet once the game launches.

Miscellaneous

– Devs have plans to support the game in Japanese, Korean, Chinese (simplified), German, and Spanish with plans to support additional ones based on demand.

– When you buy super quickly with two separate purchases of same size, same user, same type on the same block, it is possible to get duplicate packs. Can be avoided by spacing out transactions.

– As of September 12th, Fuel games has 15 full-time employees. Lots of devs are working on the Apollo platform which underpins all their games, as well as the games themselves.

– GU team overseas about 70 different artists from different studios who have all come together to create the beautiful card art. Each artist is sent a description for each piece of art which are commissioned exclusively for the game.

– The concept of renting/lending cards as well as distributing prize winnings in a trustworthy way (with blockchain contracts), and this in turn enabling an E-sports team ownership infrastructure has been acknowledged as “awesome” by devs. They will try to push this concept forward.

– The Etherbot promotional set and how to claim the cards (for part owners) will be revealed at the same time as the GU in-house marketplace – because this will be the marketplace for both GU and Etherbots.

– In terms of blockchain code security, an external contract developer was hired to perform an audit for the Genesis contract (it’s also been reviewed by MANY people). Additionally, Devs will be deploying new contracts for Season 1+ to add functionality such as single card activation. All these contracts will also undergo an external audit.

– There will be no rush to try and reserve the desired in-game username as they will not be required to be unique.

– Game APIs (including image API) are being moved around in preparation for Beta and will receive a large update soon. Fansites relying on these APIs may experience repeated downtimes as a result.

– The game will eventually be released on mobile/tablet, but launching on PC first is the priority.

To interact with the Gods Unchained community or dev team, make sure to drop by the official Discord.

Disclosure: Some of the links in this article are affiliate links. If you’ve found this guide helpful, feel free to purchase Gods Unchained packs using our referral code (at no extra cost to you).

Trending

-

Articles6 years ago

Articles6 years agoGods Unchained Guide: Investing In The First Blockchain TCG

-

Articles4 years ago

Articles4 years agoBlankos Block Party: The First True AAA Blockchain Game?

-

Articles4 years ago

Articles4 years agoNBA Top Shot: The First Mainstream NFTs?

-

Articles6 years ago

Articles6 years ago13 Rules of ICO Investing

-

Articles4 years ago

Articles4 years agoPolyient Games: The Ultimate NFT + DeFi Ecosystem?